Indicator

Description: The tax on real estate is the largest source of revenue for all localities in Virginia. Real estate taxes are anticipated to represent over 65% of the county’s total General Fund revenue in the current Fiscal Year (FY19) Budget. Because counties in Virginia only have those powers expressly granted to them by the Virginia General Assembly, Fairfax County’s flexibility to raise revenue, diversify its tax base, and reduce its over-reliance on real estate taxes is limited. Consequently, real estate values are a critical driver of the county’s ability to provide services and maintain a high quality of life for residents and businesses.

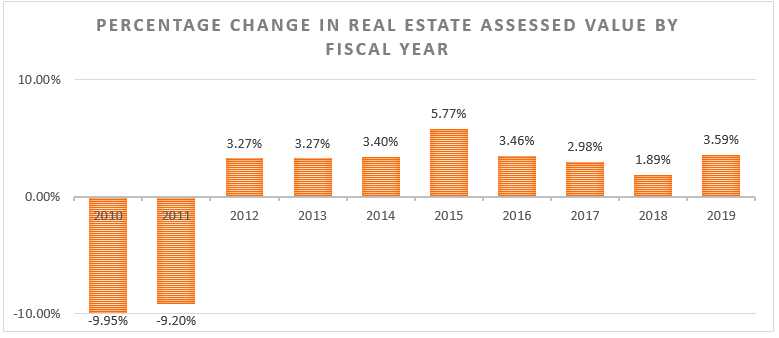

Performance Measure: Percentage Change in Real Estate Assessed Value by Fiscal Year – shows the percentage change in the assessed value of real estate in the county by fiscal year. Fairfax County reassesses real estate values on an annual basis. Real estate must be assessed uniformly and at 100% of the fair market value. Changes in residential real estate assessed values are impacted by housing market dynamics such as the supply of homes for sale on the market, demand for new homes, and affordability. Commercial real estate values are impacted by vacancy rates, rent rates, and new development. Total assessed value includes all categories of both residential properties and commercial properties. Different categories of property may experience different changes in assessed value based on location or differences in demand for different building products.

Data: See chart below.

Interpretation: Assessments have increased for eight straight years. The 3.59 percent increase in FY19 is comprised of an increase of 2.58 percent in the market value of property and an increase of 1.01 percent is attributable to construction, remodeling or rezoning, a higher rate of increase overall and within each category compared with FY 2018. Of note, the values for mid- and high-rise office properties, the largest component of the nonresidential tax base, experienced a 2.82 percent increase in FY 2019 after declining 1.39 in FY 2018.

Source: Fairfax County Department of Management and Budget Please see the FY 2019Adopted Budget Plan, General Fund Revenue Overview for additional information.