Indicator

Description: Venture capital helps translate innovative ideas into commercial applications. While not all ventures will be successful, creating opportunities for entrepreneurs to connect with capital increases the probability of bringing innovative ideas to market. Over the long term, this can lead to new business starts, job creation, and overall economic growth.

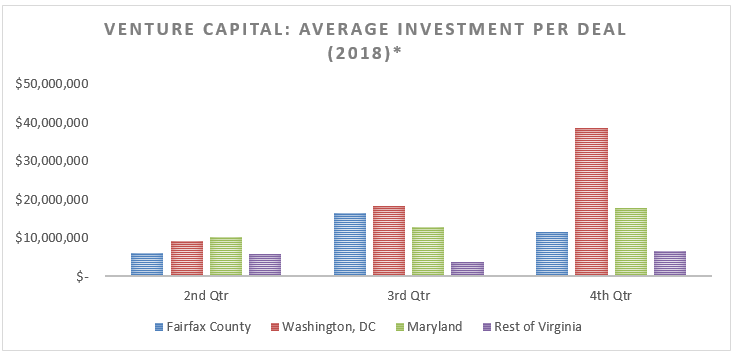

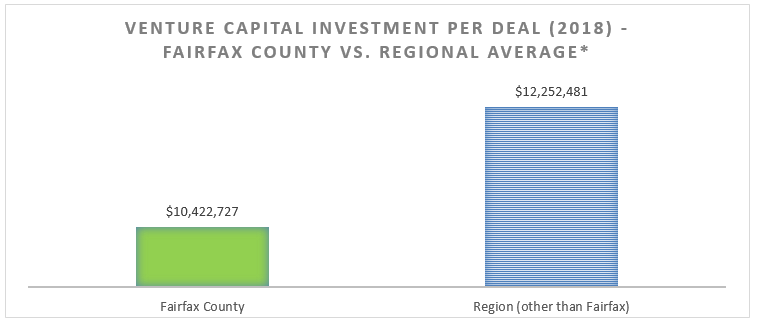

Performance Measure: Average Venture Capital Investment per Deal – compares the average investment per venture capital deal for Fairfax County against the Washington DC, Maryland, and Virginia regional area. This is based on disclosed investments deals.

Data: This is new data being collected and analyzed by the Fairfax County Economic Development Authority. Currently, only 2nd (April 1 to June 30), 3rd (July 1 to September 30), and 4th (October 1 to December 31) quarter 2018 data is available.

Interpretation: In 2018, the Fairfax County Economic Development Authority (FCEDA) obtained new capital investment data that will provide for enhanced data analytics, benchmarking, and reporting. Based on available data (April 1 through December 31, 2018), Fairfax County’s average venture capital investment deals were slightly behind the regional (Maryland, Washington, DC, and the rest of Virginia) average by approximately $1.8 million.

Source: Fairfax County Economic Development Authority Venture Capital (Third Quarter 2018)