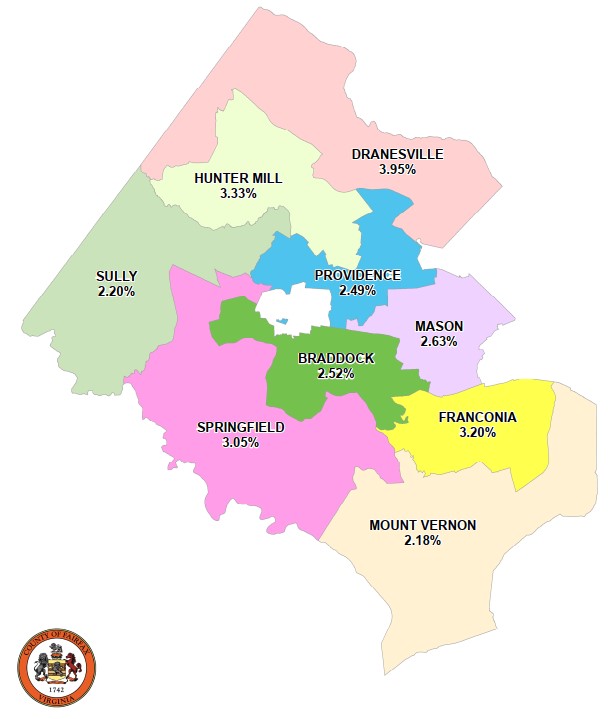

Fairfax County 2024 Tax Assessment Year Mean Residential Equalization Change by Magisterial District

Vacant and Improved Residential Property (Equalization Only)

Property owners should note that the mean and median percentages may vary significantly by neighborhood within each magisterial district.

|

District |

Mean Percent |

Median Percent |

|---|---|---|

| Braddock |

+2.52% |

+2.04% |

| Dranesville |

+3.95% |

+3.54% |

| Franconia |

+3.20% |

+2.97% |

|

Hunter Mill |

+3.33% |

+2.56% |

|

Mason |

+2.63% |

+2.44% |

|

Mount Vernon |

+2.18% |

+1.81% |

|

Providence |

+2.49% |

+1.43% |

|

Springfield |

+3.05% |

+3.20% |

|

Sully |

+2.20% |

+2.85% |

Real Estate Tax Assessments - Residential Equalization Changes in Surrounding Jurisdictions

|

Jurisdiction |

Total Residential |

|---|---|

|

Alexandria |

+2.98% |

|

Arlington |

+3.00% |

|

Falls Church |

+3.23% |

|

Fairfax City |

+2.63% |

|

Fairfax County |

+2.86% |

|

Loudoun |

+4.53% |

|

Prince William |

+5.50% |