Fairfax County’s Department of Tax Administration (DTA) is responsible for the assessment, billing, and collection of Fairfax County taxes, fees, and other sources of revenue for Fairfax County.

Our Vision

Generating revenue fairly, to help the county protect and enrich the quality of life for the people, neighborhoods, and diverse communities of Fairfax County.

Our Mission

To uniformly and efficiently assess and collect county revenue, provide high quality customer service, and promote an empowered, well-informed community.

Our Philosophy

As Fairfax County government employees, we are committed to excellence in our work. We celebrate public service, anticipate changing needs and respect diversity. In partnership with the community, we shape the future. DTA employees are committed to this philosophy through our values:

- Excellence in what we do and pride in who we are

- Lead by example

- Take ownership of customer need

- Better service through innovation

- Promote teamwork among a diverse workforce and community to achieve mutual success

- Honesty and integrity in public service

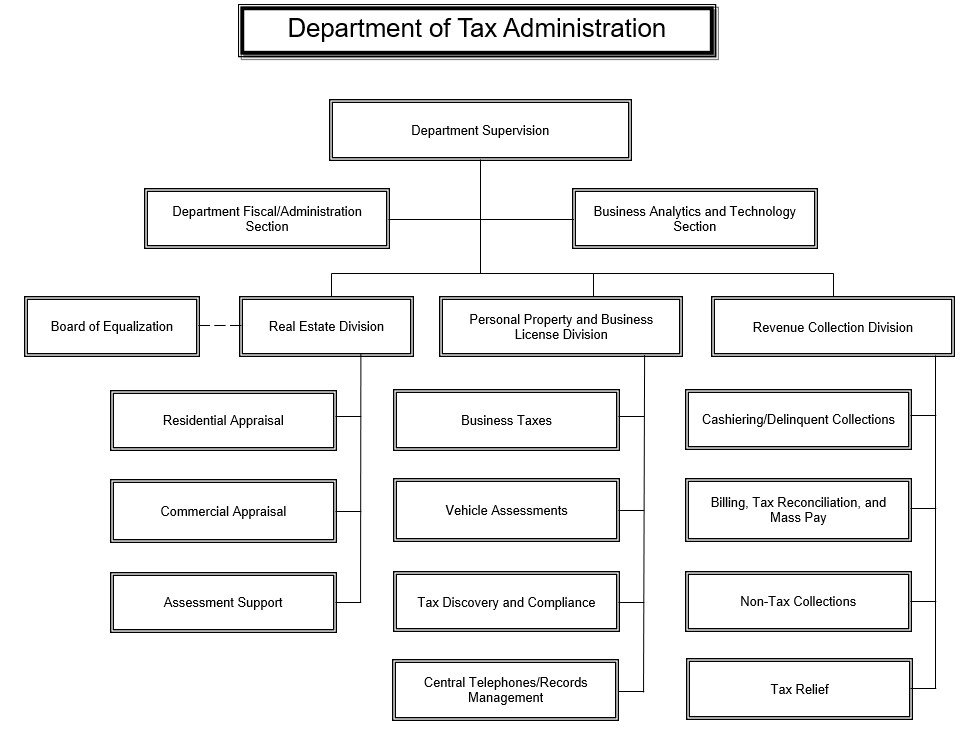

Below is a chart detailing the organizational structure of the Department of Tax Administration:

Divisions

The Department of Tax Administration (DTA) is split into three divisions and one management level, each with its own organizational structure and responsibilities—Department Supervision, the Personal Property and Business License Division, the Real Estate Division, and the Revenue Collection Division.

Department Supervision

Department Supervision is headed by Jay Doshi, Director, Department of Tax Administration. In pursuing DTA’s vision of “generating revenue fairly”, the Department Supervision section is concerned with promoting an efficient and effective tax system that focuses on accurately applying the law, following fair professional standards, and maximizing collections. This section oversees all DTA operations and takes the lead in the department’s strategic planning and implementation process including information technology planning as it relates to the administration of taxes. Resources are reallocated across division boundaries to ensure that taxes are properly billed, collection rates remain strong, and taxpayers receive responsive customer service. Increased automation and streamlining of operations have been implemented wherever possible to address the needs of county residents with fewer staff and budgetary resources.

Personal Property and Business License

The Personal Property and Business License Division (PPD) is headed by Young Tarry, Director. This division is responsible for:

- Ensuring that all vehicles garaged in the county are accurately, fairly and uniformly assessed for personal property taxation.

- Ensuring that all businesses conducting business in the county are licensed and accurately assessed for tangible property taxes.

- Administering the vehicle discovery and compliance program to ensure that all vehicles garaged in the county with non-Virginia license plates are registered and assessed for personal property taxes.

- Administering the business discovery and compliance program to ensure that new and existing businesses in Fairfax County are properly filing with the county for business tangible property, Business Professional and Occupational License (BPOL).

- Administering a variety of local license taxes such as transient occupancy tax, short term daily rental tax, and bank franchise tax.

- Managing DTA’s main call center providing customer service support for Personal Property, Real Estate, parking tickets and dog licenses.

- Handling all taxpayer inquiries received by mail, email, fax and DTA's online communication tool.

- Administering the dog license program.

In addition to the assessment of all vehicle and business-related taxes in the county, this division includes the department’s mail room, handling all incoming and outgoing mail, sorting and filing all documents, and preparing documents for archiving.

Real Estate

The Real Estate Division (RED) is headed by Thomas Reed, Director. This division is responsible for:

- Ensuring that the valuation of commercial and residential properties is completed in an accurate and uniform manner throughout the county while adhering to professional standards. Virginia law requires that assessments be uniform and at fair market value.

- Fairly reviewing and rendering decisions on administrative appeals of real property assessments.

- Ensuring that the administration associated with the assessment of all real estate properties is accurately processed to allow for proper taxation of real estate taxes.

- Fairly reviewing and rendering decisions on applications for exemption of real property taxes.

Revenue Collection

The Revenue Collection Division (RCD) of DTA is headed by Gregory Bruch, Director. This division is responsible for:

- Producing and delivering all tax bills and informational inserts to citizen and commercial taxpayers for all tax types.

- Processing tax and non-tax payments and explaining tax requirements to taxpayers at the main cashiering counter.

- Posting payments received from multiple sources including the county’s secure online payment sites, banking contract lockbox, mortgage companies and contracted collection agencies and attorneys.

- Collecting delinquent tax and non-tax revenue owed to the county.

- Overseeing accounts referred to outside collection agencies and attorneys.

- Balancing and financial reporting associated with accurate accounting of tax revenues into the county’s financial system.