Quick Summary

- Every Fairfax County business must get an annual Business, Professional, Occupational License, including home-based businesses.

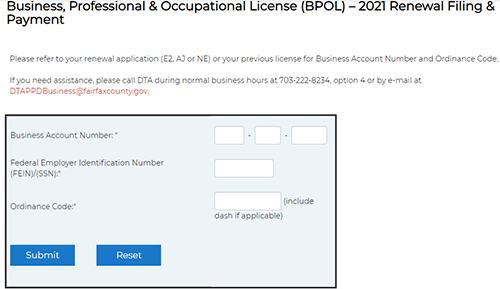

- The quickest, easiest way to file and pay is online.

- COVID-19 loans or grants — such as Economic Injury Disaster Loans (EIDL), Paycheck Protection Program (PPP) loans and Fairfax Rise grants — can be excluded from taxable gross receipts for BPOL purposes.

When it comes to business licenses, it doesn’t matter if you’re an architect, doctor, childcare provider, Uber driver, car mechanic, dog groomer, builder, independent contractor working from home or a Fortune 500 corporation.

Every Fairfax County business must get an annual Business, Professional, Occupational License — or BPOL for short—including home-based businesses. (However, businesses located in the cities of Fairfax, Falls Church and Alexandria, and the towns of Clifton, Herndon and Vienna do not need a county BPOL license.)

Renewal notices were mailed to business owners in January.

To avoid a 10% penalty, the deadline to renew BPOL licenses is Monday, March 1. The easiest and fastest way to renew is online. Renewing online is free when paying with a checking or savings account. A 2.5% service fee applies to credit and debit card payments.

NEW BUSINESSES MUST REGISTER

Businesses are required to register with the Fairfax County Department of Tax Administration within 75 days of starting operations in Fairfax County. A 10% penalty will be charged for failing to file within 75 days.

Businesses that are applying for a BPOL license for the first time may also do so online.

To apply, businesses will need the following information:

- IRS taxpayer ID number (FEIN)

- NAICS code

- Owner name

- Trade name

- Business address

- Description of business

- Estimated first year gross receipts/purchases

- Begin date

- Authorized signature/title

- Contact Information

Contractors, builders or developers must also submit a copy of a state contractor’s license, and architecture and professional engineering businesses must provide proof of a state professional license or proof this license isn’t required.

ANNUAL LICENSE FEE

The annual license fee depends upon a business’s gross receipts (or purchases, in the case of wholesalers):

- There is no fee for businesses with gross receipts of $10,000 or less.

- The fee is $30 for gross receipts of $10,001 to $50,000.

- The fee is $50 for gross receipts of $50,001 to $100,000.

- A variable rate applies for gross receipts of $100,001 or more.

COVID-19 loans or grants — such as Economic Injury Disaster Loans (EIDL), Paycheck Protection Program (PPP) loans and Fairfax Rise grants — can be excluded from taxable gross receipts for BPOL purposes.

Learn more about the exclusion for COVID loans and other frequently asked questions on paying your BPOL taxes.

WE’RE HERE TO HELP

For more information or questions, contact the Fairfax County Department of Tax Administration.

Get help at your convenience, and schedule an appointment for help over the phone or by video.

You also may send an email.

Finally, you may call 703-222-8234 (option 4), TTY 711, from 8 a.m. to 4:30 p.m. weekdays. You also may visit the Fairfax County Government Center for help in-person on Mondays, Wednesdays and Fridays from 9 a.m. to 3 p.m.

SIGN UP FOR DAILY EMAIL HEADLINES

SIGN UP FOR DAILY EMAIL HEADLINES