The Fairfax County Board of Supervisors today approved expanding the real estate tax relief program for seniors and people with disabilities.

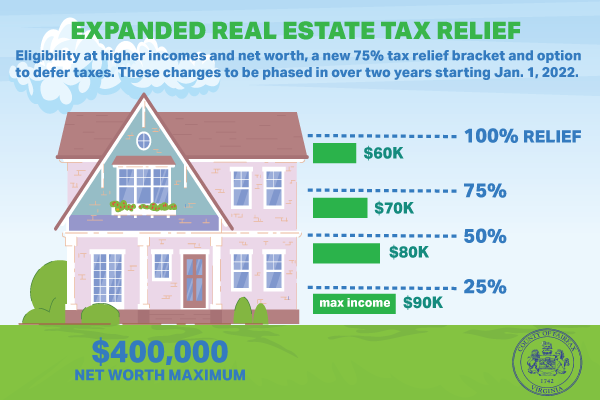

The expanded program will now allow people with higher incomes and net worth to qualify, add a new 75% tax relief bracket and offer an option to defer tax payments. These changes are the first to the program in more than 15 years.

The increased relief will be phased in over the next two years starting in January.

HIGHER INCOME AND NET WORTH TO QUALIFY

Under the program’s newly expanded qualifications, the maximum income and net worth limits to qualify for tax relief were raised, and these changes will take effect on Jan. 1.

The maximum gross income to qualify for tax relief has been raised to $90,000 from the previous $72,000 limit. Similarly, the limit on net worth increased from $340,000 limit to $400,000.

Additionally, the expanded program lets homeowners exclude up to five acres of land that cannot be subdivided from the net worth calculation for homes.

NEW TAX RELIEF BRACKET AND TAX DEFERRAL

In addition to the higher income and net worth limits, the program adds a new 75% relief bracket, a cap on the total taxes relieved and an option to defer tax payments. These changes would take effect on Jan. 1, 2023.

The new 75% relief bracket will be available to households with a total combined income between $60,001 to $70,000, and the amount of tax relief for all tax relief brackets would be capped at 125% of the mean assessed value of Fairfax County homes.

Residents now also have the option to defer paying real estate taxes, subject to interest. To qualify, households may have up to a total combined income of $100,000 and net worth of $500,000. Any deferred taxes would be subject to interest at the Wall Street Journal prime rate, plus 1% per year, subject to a maximum rate of 8% per year.

TYPES OF TAX RELIEF AVAILABLE

Fairfax County provides tax relief on real estate and personal property if certain qualifications are met. There are exemptions available for:

- Disabled veterans and their surviving spouses

- Surviving spouses of a member of the armed forces killed in action

- Surviving spouses of a first responder killed in the line of duty

Additional circumstances may also allow for tax reduction.

For more information about tax relief and qualifications, contact the Fairfax County Department of Tax Administration at 703-222-8324, TTY 711.

# # #

SIGN UP FOR DAILY EMAIL HEADLINES

SIGN UP FOR DAILY EMAIL HEADLINES