Quick Summary

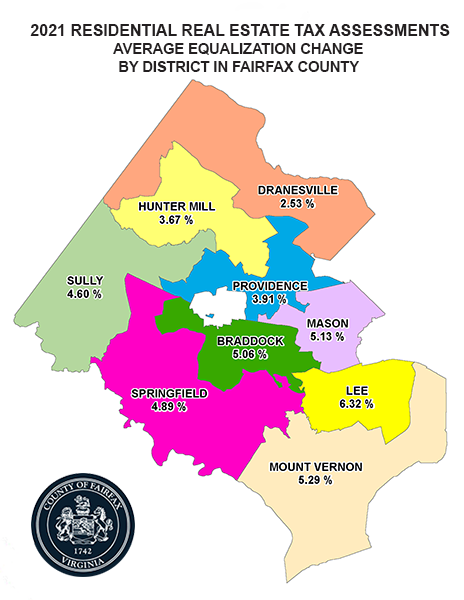

- Residential real estate assessments are up an average of 4.25% countywide.

- The average assessment for all homes is $607,752 with townhouses seeing the largest percentage increase in assessed value followed by condos and single family, detached homes.

- Record low interest rates and low inventory have caused home prices to increase in most areas of the county.

More than 356,000 updated 2021 real estate assessments are available online and are being mailed to all property owners. Based on equalization changes (market-driven value increases or decreases for your home), countywide residential real estate assessments are up an average of 4.25%, with the average assessment for all homes at $607,752. In 2020, the countywide average home assessment was $582,976.

Despite the pandemic, housing prices increased in most areas of the county because of record low interest rates and low inventory. However, commercial real estate — especially restaurants, retail and hotels — declined in value due to increases in vacancies, collection loss, and overall market risk.

88% of Home Values Are Up

Of the total number of residential properties, 88% increased in value due to what’s called equalization which are market-driven increases or decreases to values. Only 4.4% saw a decrease in value, and assessments are unchanged for the remaining 7.6%.

The breakdown of average home assessments (averages are not necessarily indicative of individual properties or neighborhoods):

- Single family detached homes – $725,327, up 4.17%

- Townhouse /duplex properties – $460,526, up 5.13%

- Condominiums – $304,877, up 4.62%

Meanwhile, nonresidential real estate values (commercial, industrial and rental apartments) values dropped by 4.05% on average.

Overall, of the 356,171 taxable parcels in Fairfax County:

- 326,263 have an assessment change.

- 29,908 have no assessment change.

Why Your Assessment May Have Changed

There are several factors that affect real estate assessments:

- Sales in the neighborhood.

- Economic factors such as average number of days homes have been for sale and sales volume.

- Improvements to the property (remodeling, additions).

- New construction and rezonings.

- Property characteristics (such as size, age, condition and amenities).

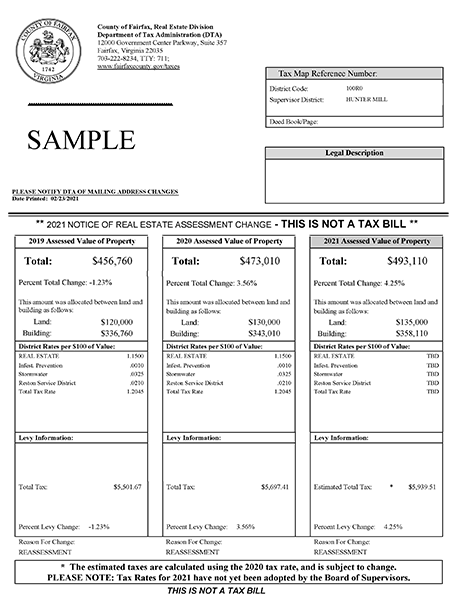

Assessments Are Not a Bill

The real estate assessment notice is not a bill. Most homeowners pay real estate tax as part of a monthly mortgage payment. Your mortgage company then sends the taxes directly to Fairfax County. However, some homeowners pay their real estate taxes directly (due July 28 and Dec. 5). Contact your mortgage company if you are not sure how your taxes are paid.

Here’s a sample assessment you’ll receive in the mail.

The Tax Levy Is an Estimate

The 2021 estimated tax levy shown on your assessment is just that — an estimate. As required by state law, the estimated tax for 2021 is based on the 2021 assessment and Fairfax County’s 2020 tax rates. This is an estimate because the Board of Supervisors has not yet adopted tax rates for 2021, but will do so as part of the budget process. The “levy,” or tax, is a combination of your current assessment and the current adopted tax rates.

Important note for participants in our tax relief program for seniors and people with disabilities: The 2021 tax estimate shown on your notice does not reflect your 2021 tax relief benefit. The filing deadline for your tax relief application is May 3. You will be notified about your tax relief status by June 30.

Appealing Your Assessment

If you believe that your real estate is incorrectly assessed, you can file an appeal. Appeals should be based on either fair market value, lack of uniformity or errors in property description. Simply saying that the value has increased too much in a single year is not a legal basis for an appeal. Before filing an appeal, we encourage you contact Tax Administration staff:

- Schedule a phone or video appointment to talk to staff at your convenience.

- Send an inquiry by email.

- Call 703-222-8234, TTY 711, on Mondays to Fridays from 8 a.m. to 4:30 p.m.

If you still wish to file an appeal, property owners may begin with an administrative appeal. Property owners are encouraged to file this appeal as early as possible. All administrative appeal applications must be postmarked or emailed by April 1 or filed online by midnight (EST) of April 1. (Note that this April deadline is new in 2021.) No administrative appeals will be accepted after this date. Both non-residential and residential property appeals may be submitted by mail or email, but only residential assessment appeals can be initiated online. You can download appeal applications or call the Tax Administration office to obtain a copy.

Real estate appeals can also be filed with the Board of Equalization (BOE). The BOE conducts formal hearings and considers sworn testimony. BOE appeal forms are available online or by calling the BOE office at 703-324-4891, TTY 711. By law, all appeals to the BOE must be filed and postmarked by June 1 for this year.

SIGN UP FOR DAILY EMAIL HEADLINES

SIGN UP FOR DAILY EMAIL HEADLINES