Indicator

Description: Responsible management of debt allows the county to leverage the bond market to facilitate the delivery of capital projects and infrastructure for the community while holding down the cost of debt to avoid impacts on other programs and services. The Fairfax County Board of Supervisors has adopted the Ten Principles of Sound Financial Management to set county debt policies to ensure that the county retains the highest possible municipal bond rating. As a result of these robust financial policies, prudent fiscal management and a strong economy, Fairfax County has been awarded the strongest credit rating possible, triple-A, from the three major national rating services. As of January 2018, Fairfax County is one of only 12 states, 46 counties and 32 cities to hold a triple-A rating from all three services. This high rating allows the county to finance borrowing at a lower cost; since the county received the triple-A rating in 1975, the associated savings are estimated at $532.87 million and, including savings from refunding sales, the total benefit equates to $815.91 million.

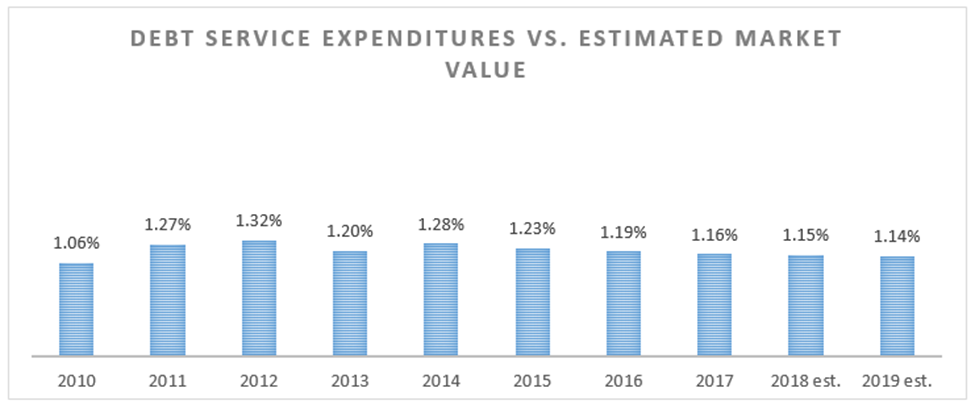

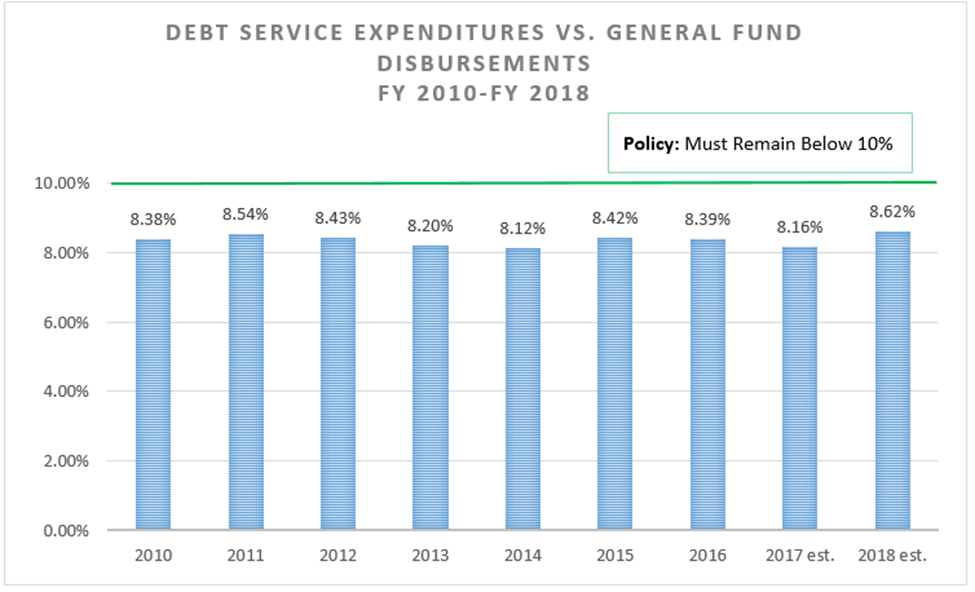

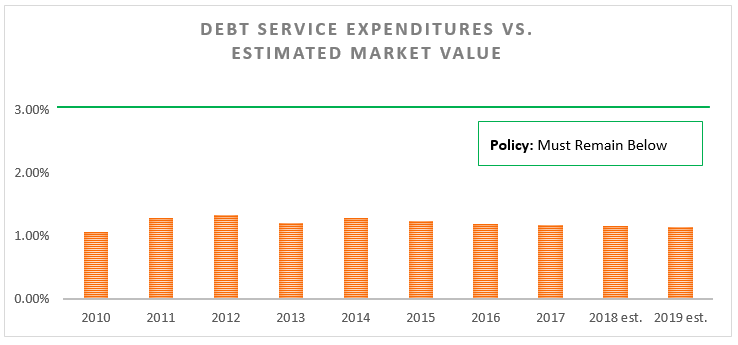

Performance Measure: Debt Service Expenditures vs. General Fund Disbursements – county debt policies include two separate debt ratio goals: first, net debt as a percentage of the estimated market value of taxable property should always remain less than three percent, and second, the ratio of debt service expenditures as a percentage of combined disbursements should remain under ten percent, as indicated in green in the chart below.

Data: See charts below.

Interpretation: Both debt ratios have always remained below the ratios established in the Ten Principles and are well below their respective targets in FY18. Debt is managed to ensure that the debt ratio policies are met while supporting the Fiscal Year 2019-2023 Capital Improvement Program as well as projected capital expenditures through FY28.

Source:Fairfax County Department of Management and Budget. Please see the FY 2019 Adopted Budget Plan, Fund 20000, Consolidated County and Schools Debt Service Fund for additional information.