The following are general questions and answer about the Fairfax Founder Fund program. These items will be updated as needed and, if updated, the date of update will be noted.

Last update: May 2025

The following are general questions and answer about the Fairfax Founder Fund program. These items will be updated as needed and, if updated, the date of update will be noted.

Last update: May 2025

The FFF is a grant and technical assistance program that provides grants of up to $50,000 to early-stage Fairfax County-based startups that are on a high-growth trajectory. FFF funds may be used to support companies’ commercialization and market entry efforts.

Complete information on the FFF is available at Fairfax Founders Fund web page or visit FairfaxCounty.gov and search “Founders Fund”.

In addition, Fairfax County hosted a webinar prior to accepting applications. A replay of the webinar can be found here.

Please reach out to Fairfax County at FairfaxCountyFoundersFund@fairfaxcounty.gov

We held a webinar on April there. The recording can be found here.

FFF has approximately $900,000 available to award. If each award is for the maximum $50,000, a total of 18 awards could be made. Fairfax County expects that more applications will be submitted than can be funded, so the review and selection process will be competitive.

Fairfax County expects to host a minimum of three FFF cohorts. $700,000 of the grant funds have been awarded so far to successful applicants.

Fairfax County does not discriminate on the basis of race, color, sex, creed, religion, national origin, age, disability, genetic information, veterans’ status, or disabled veterans’ status. The County uses the federal Small Business Administration (SBA) definition of “socially disadvantaged” to identify these groups and individuals. While the review and selection process will not preference these groups, Fairfax County will actively promote the FFF to these groups.

** New as of April 4, 2023**

The Commonwealth Commercialization Fund (CCF) is a state-funded grant program managed by the Virginia Innovation Partnership Corporation (VIPC) designed to drive economic growth across all parts of Virginia, including in Fairfax County. CCF makes non-dilutive investments in the development and commercialization of targeted, high-potential technologies and industries by both Virginia's small business community as well as its colleges and universities. While there may be overlap of the Fairfax County-based startups that may be eligible for CCF and FFF funding, and while VIPC is supporting Fairfax County in administering the County-funded FFF, there is no connection between the two programs. Applications to FFF and CCF are handled and considered separately and award decisions for one will have no bearing on the other.

In order to apply for FFF funding, you must have an already incorporated entity; have a federal employee identification number (FEIN, “tax ID”); be registered with the Virginia State Corporation Commission (SCC) to do business in Virginia; and have a valid Business, Professional, and Occupational License (BPOL) issued by Fairfax County or one of the Towns of Herndon, Vienna, or Clifton. A valid federal tax ID number, SCC entity ID, and BPOL account number are required within your application.

Please contact the Department of Tax Administration (DTA) for information about obtaining a Fairfax County issued BPOL in Fairfax County : Department Homepage | Tax Administration

No. Your company may be incorporated in any state provided it’s registered to do business in Virginia; has its principal place of business in Fairfax County or one of the Towns of Herndon, Vienna, or Clifton; has a valid Business, Professional, and Occupational (BPOL) issued by Fairfax County or one of the Towns of Herndon, Vienna, or Clifton; and meets the other eligibility criteria.

Applicants may submit one application per company (companies that are affiliated through ownership, common management, or leadership, and/or other control are considered under the same umbrella and may participate through one total submission). Companies that are affiliated with one another through majority ownership, common management, or common leadership, will be considered by the FFF as a single entity for purposes of awarding grants. Please see below for a description of the review and selection process.

For the purposes of the program, innovation has two components: novelty and utility. The idea needs to be new and useful for it to lead to a commercial opportunity.

Products are discrete individual objects constructed via a process that allows for consistent repetition and predictability. For FFF, products are not processes or services. Products may contain more than one technology and may also be comprised of different pieces/parts or any number of systems.

Applications for the third cohort are now closed.

Applicants who are not yet ready to apply or are not selected for award during the third cohort should monitor Fairfaxcounty.gov/Economic-initiatives/Fairfax-Founders-Fund. For more information on potential future rounds and other Fairfax County opportunities, sign up for the Economic Initiatives newsletter.

Applications were accepted through May 2025. The multi-tier review process will begin once an application is submitted. Award notification is planned for late summer/early fall 2025.

The review and selection process includes three components:

Review Component 1: The grant administrator will review applications for eligibility.

Applicants interested in seeking FFF grant funding will initially submit details about their company, technology, and proposed project electronically through the online portal. The grant administrator will review applications submitted within the open application period on an ongoing basis. Applicants that are deemed ineligible will be notified by the Fairfax County Department of Economic Initiatives (DEI).

Review Component 2: DEI will evaluate eligible applications for completeness and demonstration of an achievable project proposal that aligns with program goals.

Applications that are deemed eligible will be reviewed by DEI staff based on the following criteria:

Applications that do not meet all of the above criteria will not advance to Review Component 3. Applicants will be provided with feedback and information about regional resources to assist their company.

Applications that are considered to meet the above criteria will be forwarded to Review Component 3.

Review component 3: DEI will engage with venture capital professionals, and/or technology / industry subject matter experts (advisors) to evaluate applications from Review Component 2 to make recommendations of funding awards.

DEI will consult with subject matter experts from organizations including the Fairfax County Economic Development Authority (FCEDA), venture capital professionals, and/or technology / industry subject matter experts (advisors) to review applications and advise on funding.

As part of Review Component 3, DEI may ask an applicant to do an interview or pitch meeting (in-person or virtual) with DEI and one or more of its advisors.

FFF grant funds may be used to support companies’ commercialization and market entry efforts. Project examples could include but are not limited to: product and prototype development, customer acquisition, market intelligence and business model validation, pilot or proof-of-concept efforts, and intellectual property strategy development.

Although we do not plan to make any information provided through FFF public, Fairfax County (including the Department of Economic Initiatives (DEI) and the Fairfax County Economic Development Association (FCEDA)) are subject to the Virginia Freedom of Information Act (FOIA). Applicant and/or Grantee information provided to the County is not confidential and may be subject to disclosure in accordance with applicable law, including the Virginia Freedom of Information Act. As part of the review components, DEI may also share information provided by the Applicant and/or Grantee with third-party consultants (paid and/or volunteer). Consequently, it is recommended that proprietary information not be provided as part of the application, reports, or other communications.

Proprietary business- or research-related information is considered that which is produced or collected by the applicant in the conduct of or a result of study or research on medical, rehabilitative, scientific, technical, or scholarly issues, which has not been publicly released, published, copyrighted, or patented. For more information, see the Virginia Freedom of Information Act (FOIA). It is highly recommended that proprietary information not be included in applications, reports, or other communications.

Applications are to be completed online via the application on the Fairfax Founders Fund web page; submissions via email or other formats outside the online portal are not accepted. Applications may be started, saved, and completed at a later date provided that they are submitted no later than the deadline. An application worksheet is also available to aid applicants in preparing their application responses ahead of populating the online form.

Once you have submitted your application through the FFF online portal (powered by Jotform), modifications to that application are not possible. If you realize an error, please reach out to FairfaxCountyFoundersFund@fairfaxcounty.gov and we will work with you on the necessary updates.

Applicants are encouraged to prepare their responses to application prompts ahead of completing the online form using the application worksheet . Please note: this worksheet is intended to be used only as a preparative tool – it will not be accepted in lieu of completing and submitting the application via the online portal.

Your FFF project is expected to be approximately 6-12 months. However, other periods of performance – shorter or slightly longer – that reflect reasonable time to completion and align with the work to be accomplished and budget are acceptable. Typically, FFF will not accept projects with periods of performance less than 3 months.

Applicants may provide letters of support with their application, but they are not required. Letters of support should come from customers and/or prospective customers only, and may be uploaded into the online application as a single, combined PDF or as individual files.

Applicants should address all prompts to the best of their ability. If the FFF application is seeking information that can’t be addressed, we suggest including a brief explanation why as part of your response, instead.

The AR is an individual who is authorized to execute legal documents on behalf of the applicant organization.

While we encourage the use of Virginia-based consultants and contractors, this is not a requirement of the FFF program.

The BPOL account number can be found on both the first page of the applicant’s Fairfax County business license and, or the applicant's business renewal form (Form 8TA-NE). The account number is a nine-digit number with three leading zeros. If your BPOL is from the Town of Vienna the account number is four digits.

Applicants should indicate the primary industry sector in which their organization operates, though there will be an opportunity to designate alignment with as many secondary industries as applicable.

Applicants must prepare a baseline budget for their project that outlines the use of FFF funds and matching funds to execute their project plan. During the application review process, reviewers will evaluate the baseline budget for compliance with the guidelines and reasonableness in light of the proposed project milestones.

Indirect costs are costs incurred by a company or organization that are not readily identifiable with a particular project or program. Common indirect costs groups are Overhead (OH) and General and Administrative (G&A). Rent, office supplies, and other expenses that are traditionally considered indirect costs will not be accepted as direct costs. Indirect costs may not be charged on equipment. FFF funds may be used to pay for indirect costs up to 20% of the total FFF request.

If applicants include equipment purchase requests, you must demonstrate that the equipment is required to advance the technology for the proposed FFF project and indicate why alternatives to procurement, such as leasing, are not viable. If the request is to purchase new equipment, indicate why used equipment is not a viable option. Indirect costs may not be charged on equipment. Award recipients that purchase approved equipment with FFF monies retain the title; Fairfax County does not take ownership.

Materials & Supplies are consumables, disposables, or other short-lifespan items, and generally are less expensive than equipment. Equipment has a useful lifespan of more than one year.

Fringe costs are payroll-related costs for employees. Common examples of fringe costs that could be covered by FFF funding include health insurance, dental insurance, life insurance, retirement plans, social security, and worker’s compensation. A fringe rate, or benefit rate, is the cost of an employee’s benefits divided by the wages paid to the employee. Should an applicant include fringe on their project budget, they’ll be prompted to include both the fringe benefits rate and what it covers.

Applicants must provide matching funds in an amount that equals or exceeds 50% of the total FFF request and that support the project during its period of performance. These funds may come from in-kind contributions, “sweat equity,” commercial revenue, other grant funding, and/or investor funds that directly supports the development of the proposed project and/or support activities including the following:

.The following cannot be used as a source(s) for matching funds:

See above comment about financing.

Yes, Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) awards may be used as a source of matching funds for your FFF project. If you have applied for SBIR or STTR funding, but not yet received a notice of award, and if the SBIR or STTR funds are required to meet your FFF match requirement, we recommend that you delay your FFF application until you receive official notice of your SBIR or STTR award.

Yes, applicants may modify the source(s) of their matching funds after an award is made provided the two-to-one minimum requirement is maintained.

Updated March 23, 2023

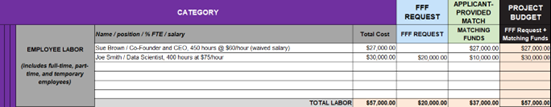

Applicants must prepare their project budget using the specified template . The budget template will ask you to lay out your FFF request and matching funds by budget category. However, requested and matching funds do not have to be in the same category or support the same cost(s) (though they can!). You will log your FFF project costs in the appropriate budget category, and then identify whether the cost will be supported by FFF, match, or both. Some costs may be entirely supported by FFF grant funds, while other costs may be entirely supported by the applicant’s matching funds, while other costs may be split between both sources.

An example follows. Here you can see that in the Labor category, CEO Susana Brown’s effort will be contributed as matching funds, while Data Scientist Jacob Smith's effort will be covered by both FFF and match. Applicants should make sure that the “Total Cost” is captured fully in either/both FFF Request and/or Matching Funds, and at the end of the day, that the total amount of matching funds provided is equal to or exceeds 50% of the total FFF request.

The Fairfax County Economic Development Administration (FCEDA) will be responsible for making FFF payments to award recipients. The grant will be disbursed in two tranches: 40% of the award will be provided within 45 days of the effective date of the grant agreement, while the remaining 60% will be provided following submission of a progress report that demonstrates that project tasks are on track and that the award recipient has spent the initial 40% and equivalent amount of matching funds. Award notifications are expected to begin in summer 2025. Consequently, award recipients should receive their initial tranche in late summer/fall of 2025.

Awardees are required to report on the technical and financial progress of the project and technology during and immediately following the period of performance. A progress report is expected when the awardee has spent the initial tranche of funds (40% of the award) and at least 40% of the total matching funds. A final report is expected by no later than 30 days after the end of the performance term, as outlined in the grant agreement. Additionally, beginning on February 1 following the end of the performance term, and for 4 more years following, award recipients will provide a brief annual report on commercialization and other economic outcomes (e.g., company revenue, fundraising amounts, headcount, etc.).

Fairfax County is not qualified to provide tax advice. We recommend that you contact your CPA or tax advisor for information about your specific situation. Fairfax County will issue a 1099 in the first quarter of 2026 for anyone that receives FFF grants.