Step 1: Status Hearing

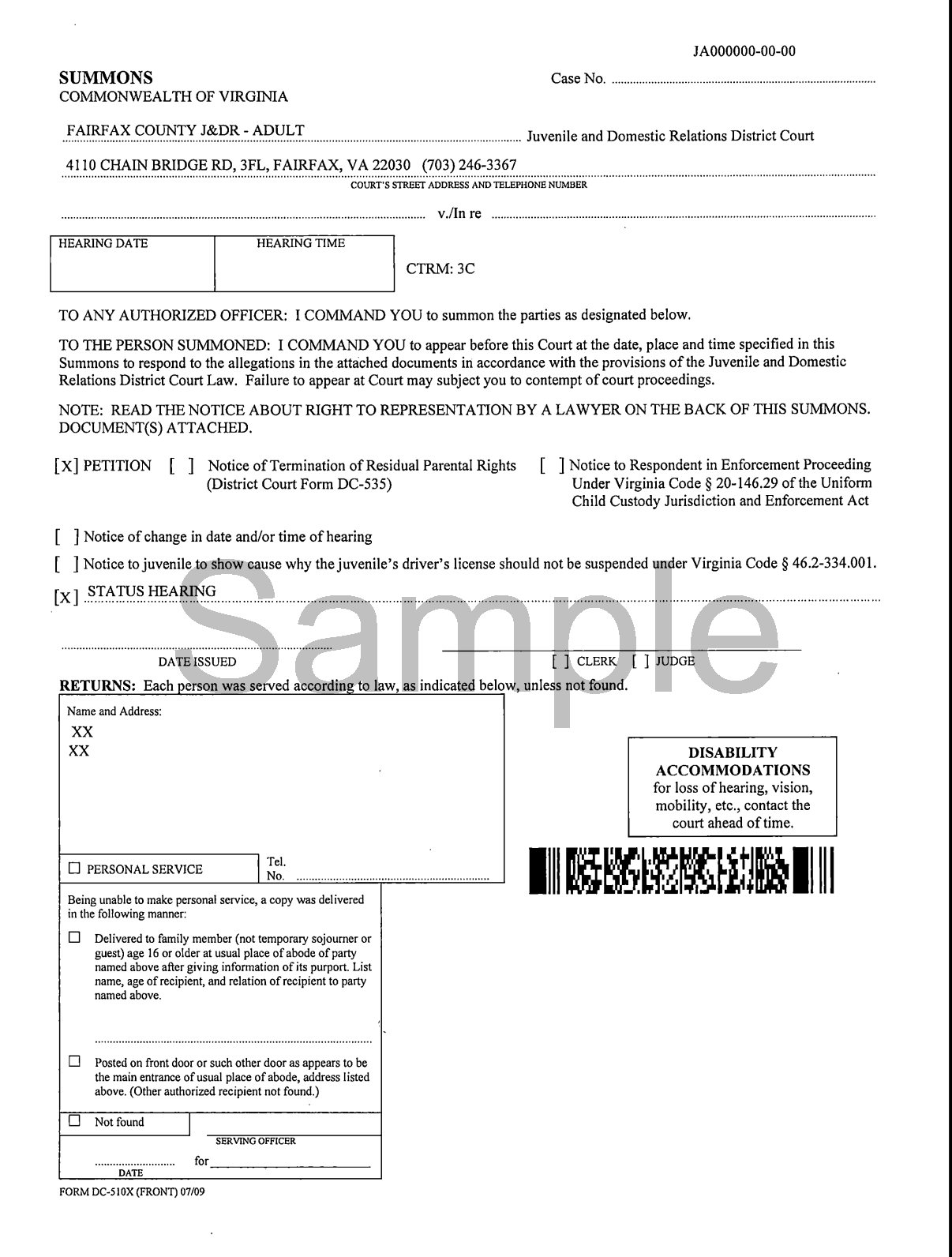

After a petition for child support or spousal support is filed, the parties will receive a summons to appear before the court for a status hearing.

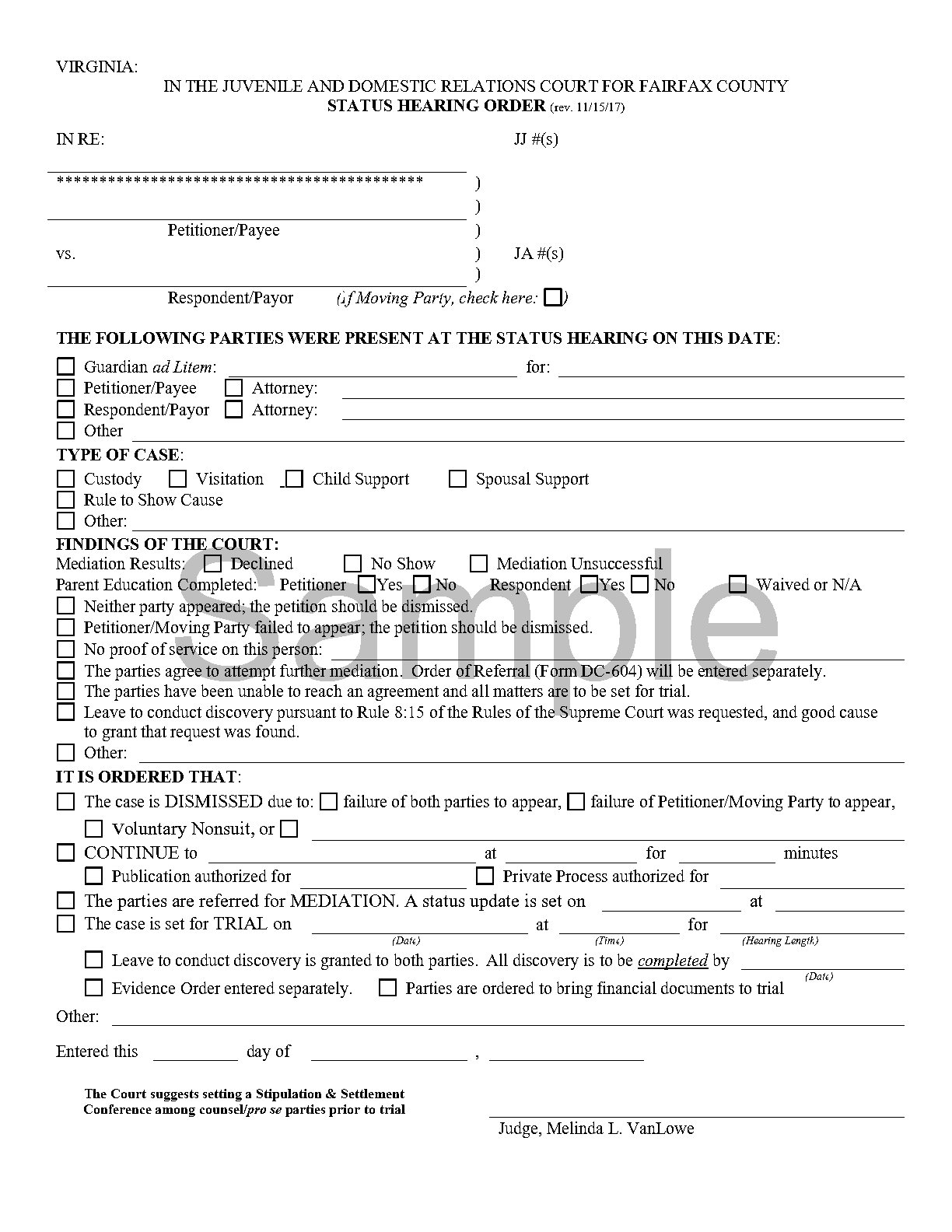

At the status hearing, the parties, and their attorneys, if an attorney is hired, will go before a judge, who will review the matters before the court. If the parties have already reached an agreement, a final order can be signed by the judge that day. If the parties have not reached agreement, the judge will refer the parties to a neutral mediator who will help the parties resolve the case, instead of having a trial.

However, if the parties attempted mediation and did not reach an agreement or mediation is deemed inappropriate, the judge will schedule a trial. At the end of the status hearing, the judge will provide the parties with an order summarizing what happened.

If the parties do not have an attorney, the judge will enter an evidence order, which is a list of financial documents that the parties must bring to trial to help the judge calculate support.

Mediation

Before the status hearing the parties will be referred to mediation, (unless the judge finds that mediation is not appropriate). Mediators are hired by the court, at no cost to the parties, and are there to work with both parties to resolve their support dispute. If, before trial, mediation does not happen or is not successful, at the status hearing, the judge will refer the parties to the mediation.

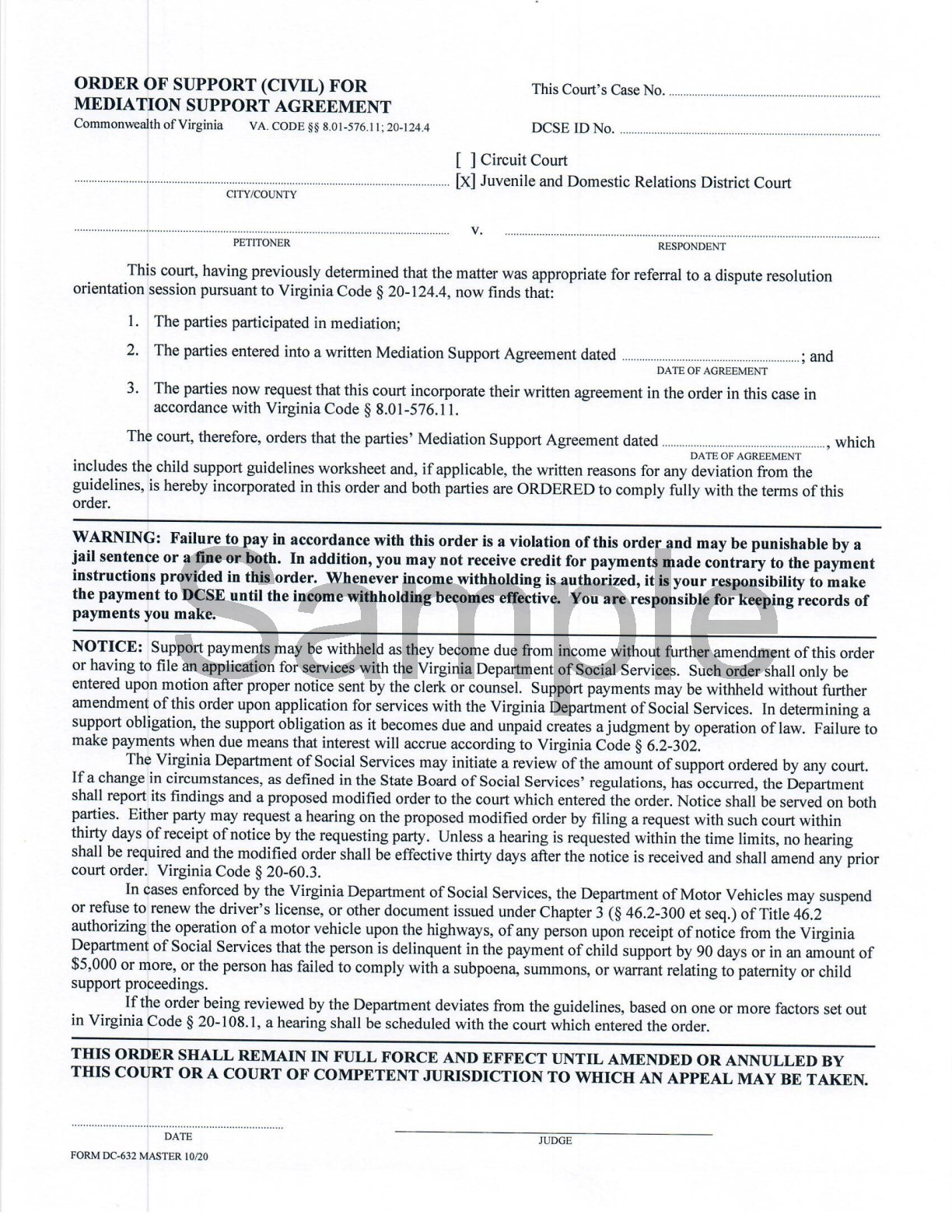

If mediation is successful, the parties’ agreement will be sent to the judge. The judge will create an order that incorporates the agreement. The parties will not return to court again.

If mediation is not successful, the parties will return to court for another status hearing and schedule a trial date.

Step 2: Pre-trial Motions

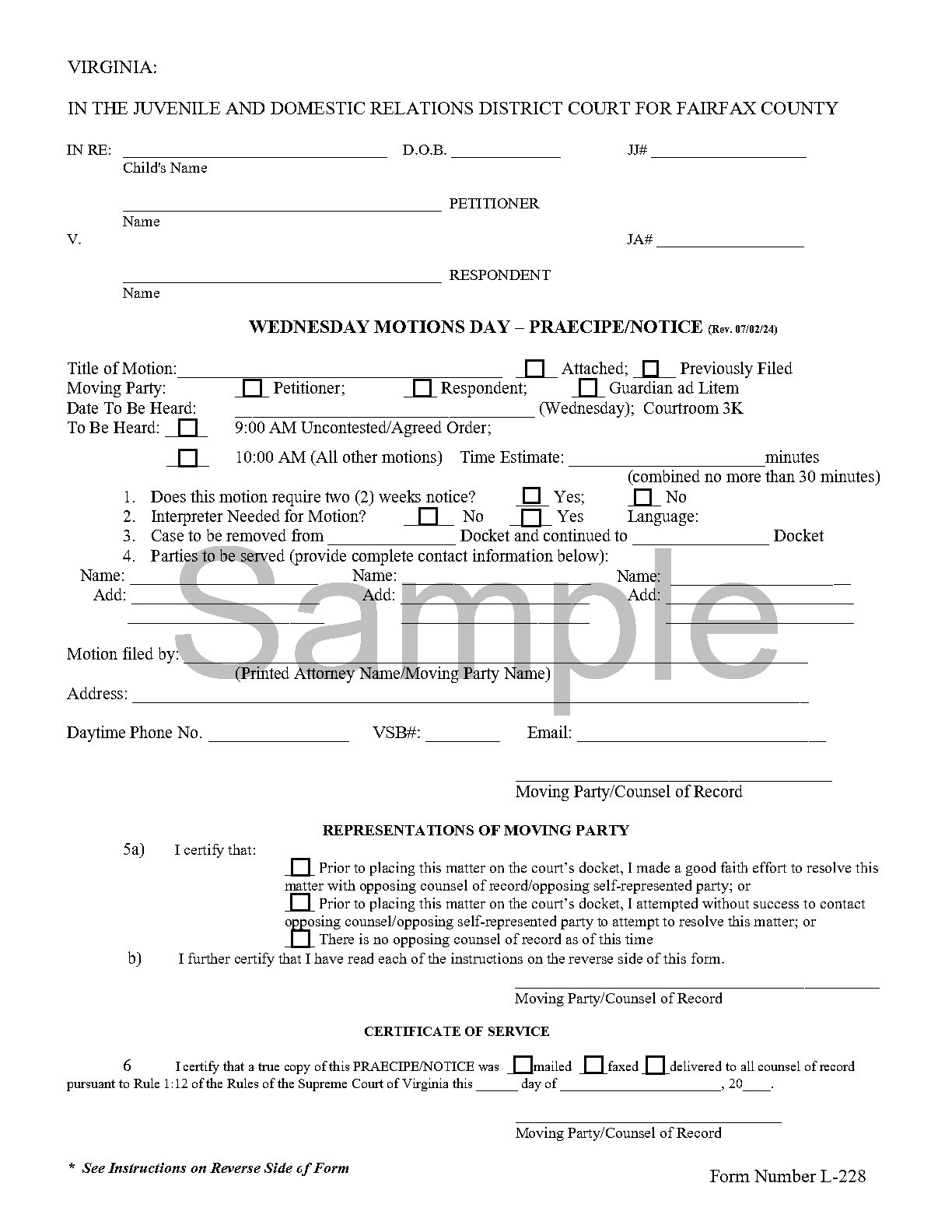

Before trial, a motion can be filed requesting that one parent, the payor, pay child or spousal support to the other parent, the payee, until the trial. If a hearing to consider the support motion will take less than thirty (30) minutes, the motion can be heard on the Wednesday Motions Docket. To schedule a motion on this Docket, the party shall complete a Yellow Motions Day Praecipe and follow the instructions on the back of the form.

If a hearing will take more than thirty (30) minutes, the parties will need to go before the Calendar Control Judge to schedule the hearing.

Step 3: Trial

At the trial, the judge will make a final decision regarding the support petition filed. Trials may not exceed three (3) hours. At the trial, the judge will hear all evidence and, in most cases, make a decision that day. Parties shall, therefore, bring all financial documents and witnesses that they want the judge to consider, to trial. All parties, regardless of whether they appear with an attorney or represent themselves, shall abide by courtroom procedures and the rules of evidence when providing the judge with documents and witnesses. Any documents submitted will be returned at the end of the trial. The judge cannot give legal advice or help you present your case.

How does the judge calculate child and spousal support?

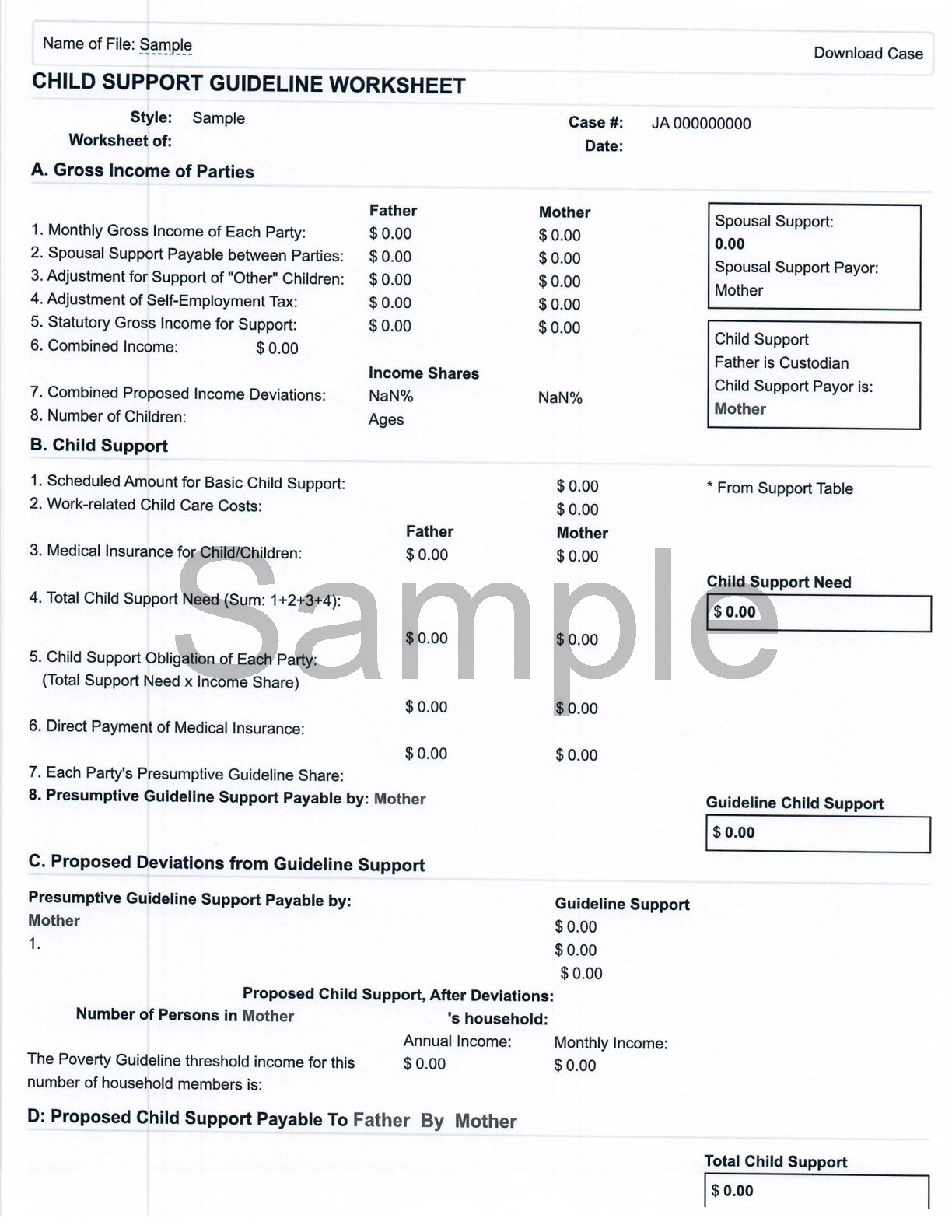

Child support

To calculate child support, the judge must first determine what the law considers to be the correct amount, which is called the “presumptive amount.” The amount is based upon the parents' combined monthly gross income, the number of children, and the number of days that the child spends with each parent. A party’s monthly gross income includes money that a parent receives from all sources unless specifically excluded by law, such as federal supplemental security income (SSI) benefits. Based upon the physical custody arrangement between the parties – primary or shared physical custody – the parties will count the number of days that the child is in the care of each parent.

After calculating child support, if judge concludes that the amount is unjust or inappropriate, the judge can change the amount based upon certain factors. Those factors are:

- Actual monetary support for other family members or former family members;

- Arrangements regarding custody of the children, including the cost of visitation travel;

- Imputed income to a party who is voluntarily unemployed or voluntarily underemployed, provided that (i) income may not be imputed to a custodial parent when a child is not in school, child care services are not available, and the cost of such child care services are not included in the computation; (ii) any consideration of imputed income based on a change in a party’s employment shall be evaluated with consideration of the good faith and reasonableness of employment decisions made by the party, including to attend and complete an educational or vocational program likely to maintain or increase the party’s earning potential; and (iii) a party’s current incarceration, as defined in § 8.01-195.10, for 180 or more consecutive days shall not be deemed voluntary unemployment or voluntary underemployment. In addition, notwithstanding subsection F, a party’s incarceration for 180 or more consecutive days shall be a material change in circumstances upon which a modification of child support may be based;

- Any childcare costs incurred on behalf of the child or children due to the attendance of a custodial parent in an educational or vocational program likely to maintain or increase the party’s earning potential;

- Debts of either party arising during the marriage for the benefit of the child;

- Direct payments ordered by the court for maintaining life insurance coverage pursuant to subsection D, education expenses, or other court-ordered direct payments for the benefit of the child;

- Extraordinary capital gains such as capital gains resulting from the sale of the marital abode;

- Any special needs of a child resulting from any physical, emotional, or medical condition;

- Independent financial resources of the child or children;

- Standard of living for the child or children established during the marriage;

- Earning capacity, obligations, financial resources, and special needs of each parent;

- Provisions made with regard to the marital property under § 20-107.3, where said property earns income or has an income-earning potential;

- Tax consequences to the parties including claims for exemptions, child tax credit, and childcare credit for dependent children;

- A written agreement, stipulation, consent order, or decree between the parties that includes the amount of child support; and

- Such other factors as are necessary to consider the equities for the parents and children.

In cases involving multiple custody arrangements, such as when one parent has sole custody of some children and shared custody of others, separate calculations are performed for each custody type, and the results are combined to determine the total child support obligation.

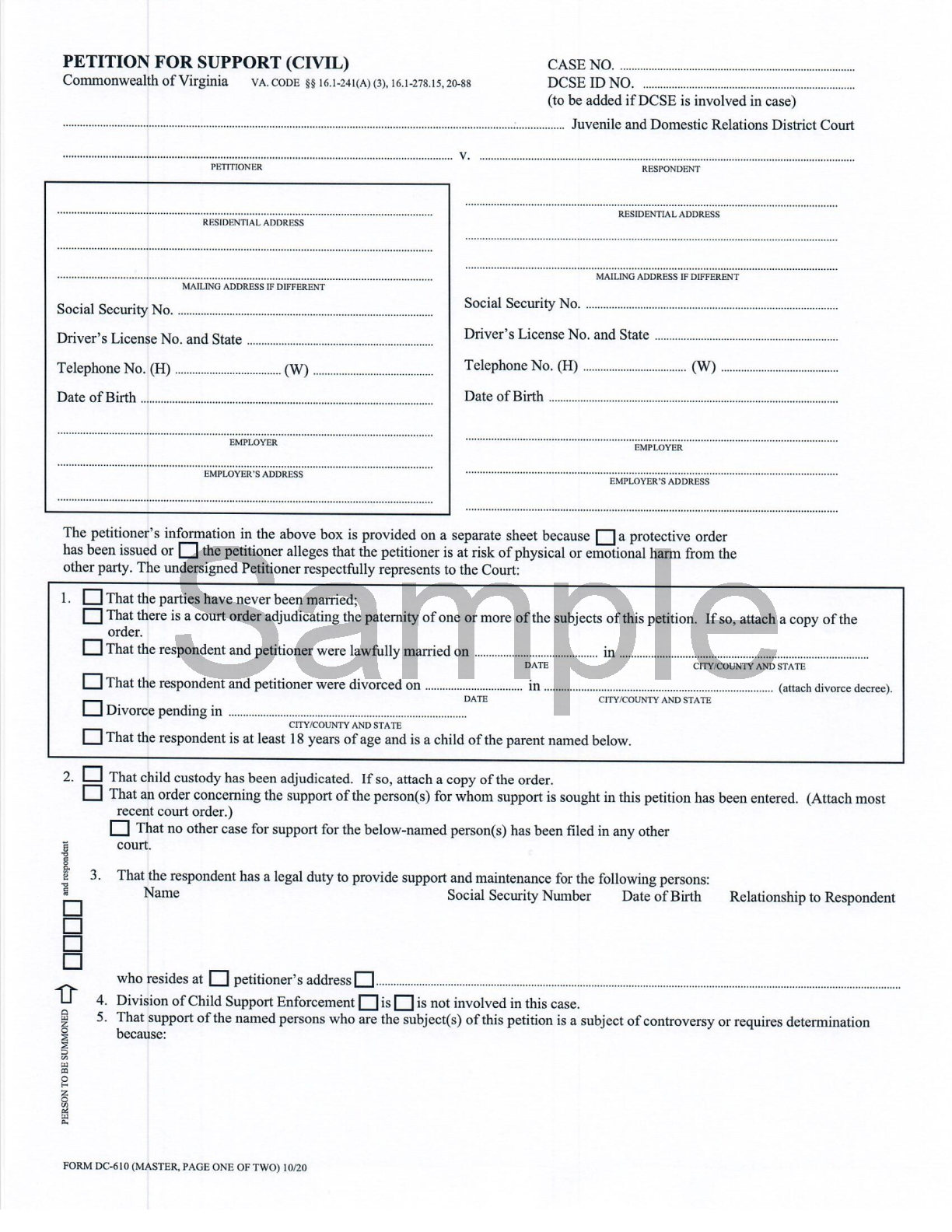

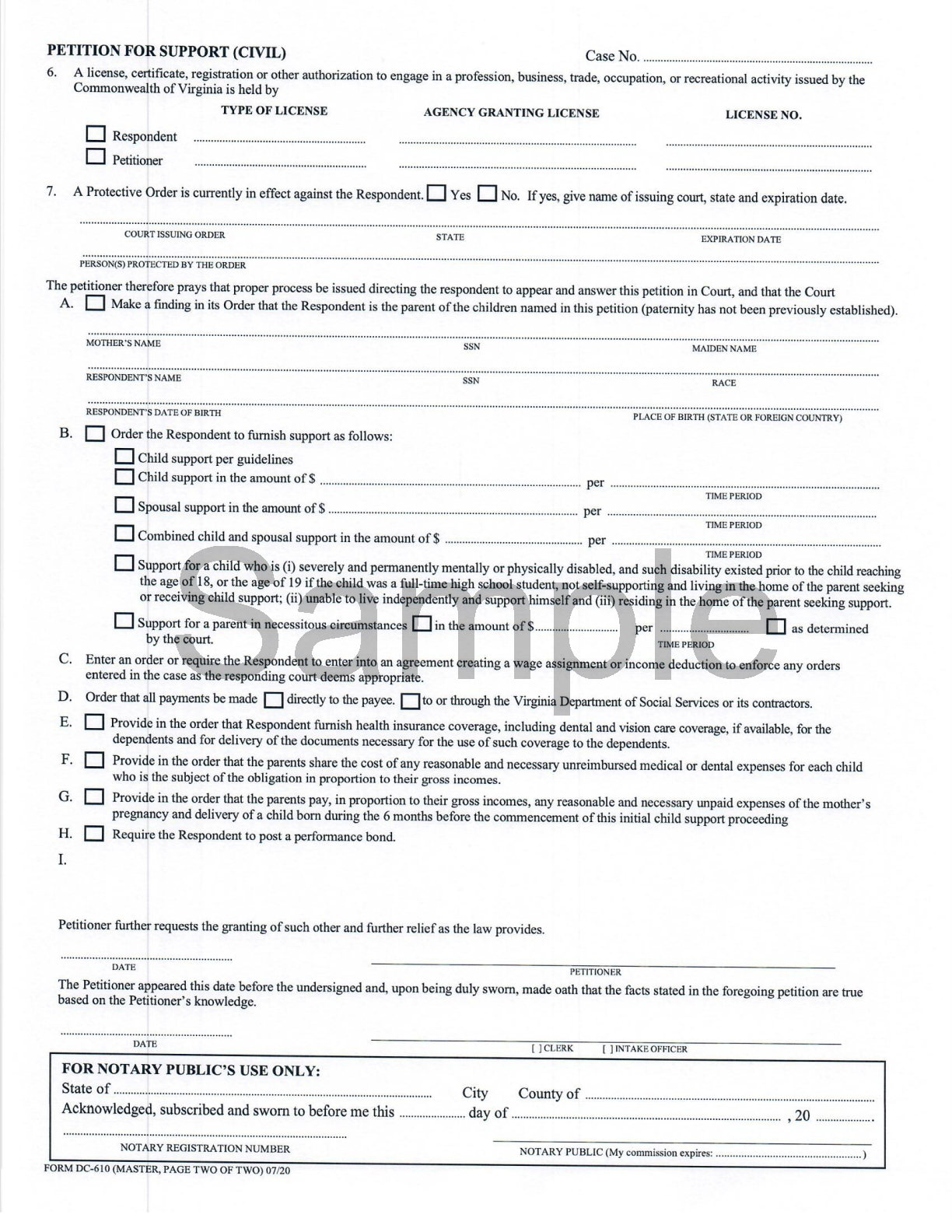

The Division of Child Support

If a parent does not have an attorney, the parent may contact the Virginia Department of Social Services, Division of Child Support Enforcement, (“DCSE”), to get assistance in collecting child support from a parent. A party must complete an application and file it with the Division to start the process. Once a case is open with DCSE, an attorney for DCSE will file a petition for child support with the court. Attorneys representing DCSE will then appear in court with the party requesting support.

For more information visit the Division of Child Support Enforcement Webpage.

Spousal Support

Parties that are legally separated may petition the court for spousal support. A court’s judgement plays a big role in determining spousal support, as spousal support is based upon the unique facts of each case. Spousal support is calculated differently at certain stages of the case.

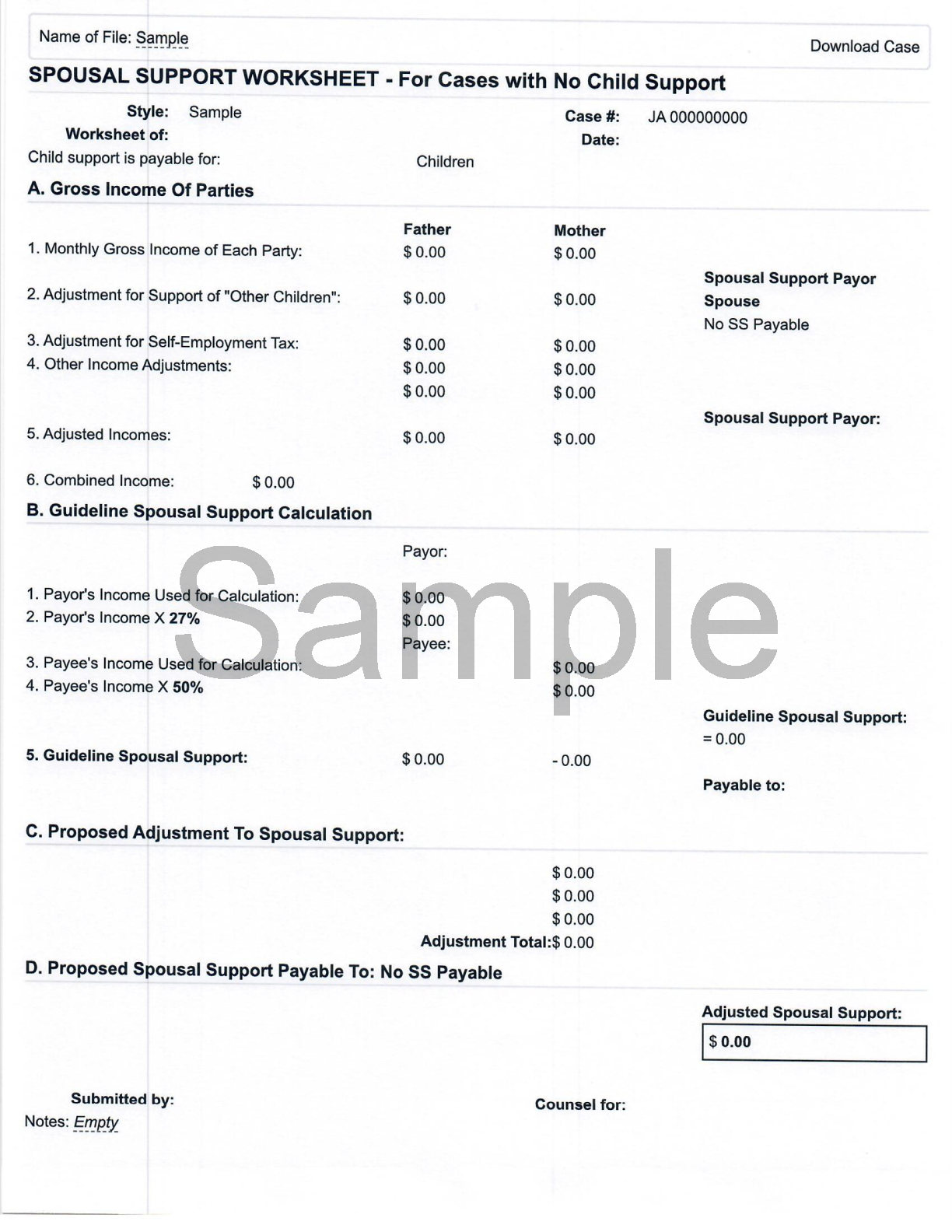

Spousal support to be paid for the period after a petition for spousal support is filed and before trial is called, “pendente lite” spousal support.

Where the parties’ combined monthly gross income, (income before taxes are removed), is less than $10,000 a formula is used to calculate the correct amount of spousal support.

The formula is the difference between 26 percent of the payor spouse’s monthly gross income and 58 percent of the payee spouse’s monthly gross income, when the parties have children.

If the parties do not have children in common, the presumptive amount of support is the difference between 27 percent of the payor spouse’s monthly gross income and 50 percent of the payee spouse’s monthly gross income.

At trial, the court will calculate spousal support based upon the parties’ gross incomes and whether they have children. After calculating spousal support, the court may adjust the amount for good cause, including evidence about the parties’ current financial circumstances.

The judge will decide spousal support based on the evidence and circumstances at the time of the trial, ensuring that the award reflects the financial realities and needs of both parties. The judge must consider the needs of the requesting spouse and the ability of the other spouse to pay. Spousal support is calculated based upon the following factors:

- The obligations, needs and financial resources of the parties, including but not limited to income from all pension, profit sharing or retirement plans, of whatever nature;

- The standard of living established during the marriage;

- The duration of the marriage;

- The age and physical and mental condition of the parties and any special circumstances of the family;

- The extent to which the age, physical or mental condition or special circumstances of any child of the parties would make it appropriate that a party not seek employment outside of the home;

- The contributions, monetary and nonmonetary, of each party to the well-being of the family;

- The property interests of the parties, both real and personal, tangible and intangible;

- The provisions made with regard to the marital property under § 20-107.3;

- The earning capacity, including the skills, education and training of the parties and the present employment opportunities for persons possessing such earning capacity;

- The opportunity for, ability of, and the time and costs involved for a party to acquire the appropriate education, training and employment to obtain the skills needed to enhance his earning ability;

- The decisions regarding employment, career, economics, education and parenting arrangements made by the parties during the marriage and their effect on present and future earning potential, including the length of time one or both of the parties have been absent from the job market;

- The extent to which either party has contributed to the attainment of education, training, career position or profession of the other party; and

- Such other factors, including the tax consequences to each party and the circumstances and factors that contributed to the dissolution, specifically including any ground for divorce, as are necessary to consider the equities between the parties.

Child support and Spousal support orders

If the parties are represented by attorneys, the child and spousal support orders shall be prepared by the attorney. Each order must also include a copy of the support guidelines calculation worksheet.

If the parties agree that neither party will pay support to the other or that one spouse will pay an amount of support different than the guidelines amount, the order must state that the amount of support is by agreement. Attorneys, however, must first calculate support according to the guidelines and include the guidelines worksheet with the order so that the court knows what the guidelines support calculation would have been, without an agreement.

If parties appear without attorneys and DCSE is not involved, the judge will prepare the order.