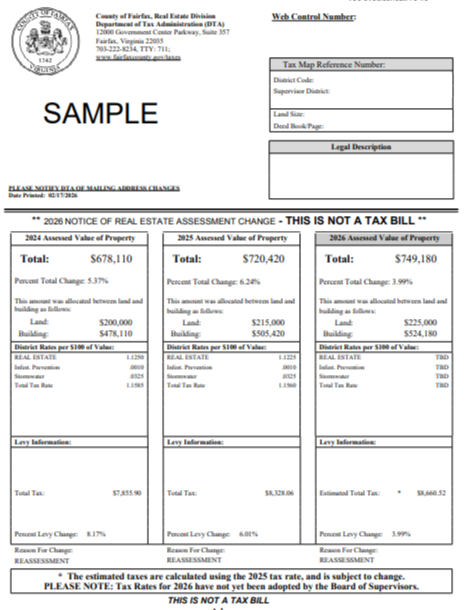

Updated 2026 real estate assessment notices are now available online and are being mailed to all property owners across the county. These notices reflect a property's assessed value and are not a tax bill.

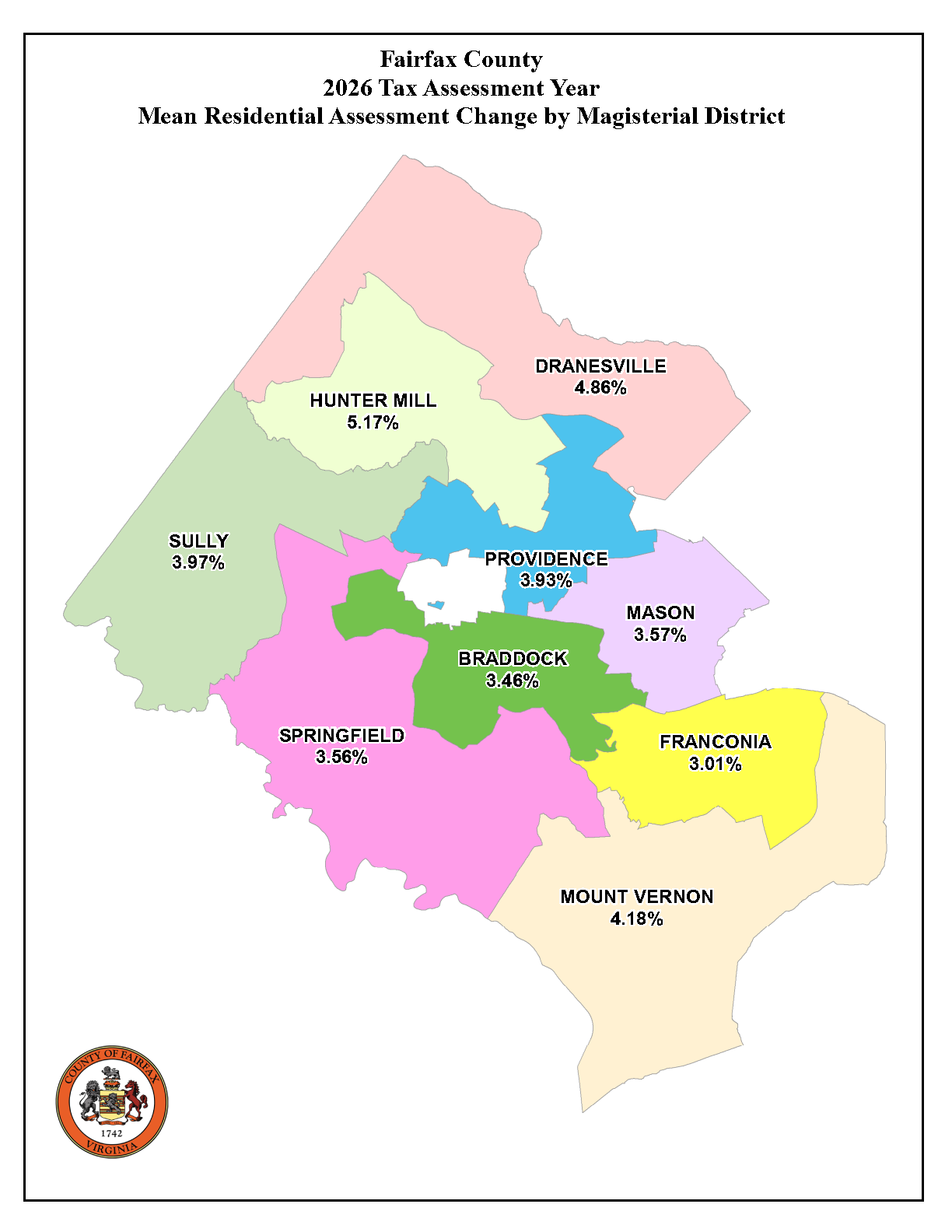

Countywide residential real estate assessments are up an average of 3.99%, based on market-driven value increases or decreases, referred to as equalization changes. The mean assessed value of all improved residential property is approximately $829,895. In 2025, the countywide average home assessment was $798,053.

In 2025, 30-year fixed mortgage rates fluctuated throughout the year but saw a slight decrease at year end from 2024, settling on average, in the lower 6% range. Inventory levels and sales volume remained relatively stable compared to the previous year, with home prices continuing their trend of appreciation. However, the rate of increase was lower than what was experienced in 2024.

To look up your current or past assessments:

- Visit the real estate assessment online database.

- Enter your address in the "Search by Property Location" section.

- Next, on the page with your property’s information, select “Values” on the left-hand side to see your present and past assessments. Or, compare the sale price of your property to others in the neighborhood by clicking on “Neighborhood Sales” on the right-hand side.

Average Assessment Values

Of the total number of residential properties, 81.2% increased in value due to equalization (market-driven increases or decreases). Nearly 8% saw a decrease in value, and assessments are unchanged for the remaining 11%.

Here is a breakdown of mean home assessments. The values are not necessarily indicative of individual properties or neighborhoods.

- Single-family detached homes – $1,012,504, up 4.28%

- Townhouse/duplex properties – $612,580, up 3.9%

- Condominiums – $387,560, up 2.94%

Overall, of the 357,018 taxable parcels in Fairfax County:

- 316,098 have an assessment change.

- 40,920 have no assessment change.

Explore how assessment neighborhood values have changed from the previous year with the 2026 RESViewer Hub. On the interactive maps, you can see property assessment changes and sales, search for residential sales in your area and filter for properties similar to your own.

SIGN UP FOR DAILY EMAIL HEADLINES

SIGN UP FOR DAILY EMAIL HEADLINES