Over the past several weeks, media attention around blockchain technology and related investments has generated interest and questions from Fairfax County residents and retirement plan members and beneficiaries. The following information is intended to help clarify the Employees’ (ERS) and Police Officers (PORS) Retirement Systems’ investments in blockchain technology.

What is Blockchain Technology?

Because cryptocurrencies such as bitcoin have been using blockchain technology for so long, more recent uses of this technology have commanded less attention. Many non-investors have little or no knowledge of blockchain technology beyond its use to store and transact cryptocurrencies. Think of blockchains as secure roads and warehouses, with cryptocurrencies being the cargo that is transported and stored. Blockchain technology is also used to securely transport and store an ever-expanding range of data – everything from financial transactions to medical records. It is this category of applications and systems that ERS and PORS are primarily invested in – not cryptocurrencies.

To learn more about blockchain technology, check out the following information from the Chartered Financial Analyst (“CFA”) Institute and the Chartered Alternative Investment Analyst (“CAIA”) Association, both widely respected investment professional accreditation organizations:

Exposure to blockchain technology is one component of an innovation theme within the broadly diversified ERS and PORS portfolios, which also includes Artificial Intelligence, FinTech, Life Sciences, and National/Cyber Security. The investment thesis surrounding blockchain is that many financial markets will eventually be digitized and recorded on blockchains, improving price discovery and settlement times. As an example, when one of our managers buys a traditional bank loan it may take a month or more for the trade to settle and involve up to seven different systems. Ownership of a wide variety of assets will eventually be held in digital format including traditional stocks, bonds, real estate, and commodities. This is also true for non-financial assets such as art.

The majority of the Retirement Systems exposure to blockchain comes in the form of traditional Venture Capital investments in growing companies. The Retirement Systems do not buy or hold any of these investments directly but employ investment firms that specialize in these innovative sectors. Thus, the Retirement Systems are “Limited Partners” in private funds. These funds draw down capital committed over a 2- to 5-year period and typically have life cycles of 8 to 12 years to realize the full growth potential of the companies in which they invest.

Some of these funds may allow for up to 20% to be invested in liquid tokens of blockchain-based protocols, and many private equity investments include provisions for tokens that may be issued by companies in the future. It is important to understand that all these investments are made with a very long time horizon in mind and do not involve trading. Liquid positions are generally held at either a trust bank or broker/dealer regulated at the state or federal level. Our managers hold very little, if any, assets at exchanges for extended periods of time where they could be commingled with other client assets.

Uses for Blockchain Technology

Blockchain technology is emerging as a game changer for multiple industries including banking, financial services and insurance, healthcare, education, real estate, supply chain and logistics, and the Internet of Things (IoT).

Because of confidentiality provisions included in the contracts we sign with the investment firms that manage blockchain investments for us (to prevent other investment firms from learning specifics about the processes and positions of the firms we do business with), we cannot always list specific blockchain technologies. Our resident experts in blockchain technology, Andrew Spellar (Chief Investment Officers for ERS) and Katherine Molnar (Chief Investment Officer for PORS) offer the following examples of how this technology is being used.

- A blockchain-based real estate property title registry system automates all transactions for brokers, realtors, and their clients, making title issuance instant.

- The Internet of Things (IoT) industry is growing rapidly with billions of connected devices. By integrating blockchain technology in IoT devices, the possibility of data breaches can be reduced to a great extent.

- Money transfer and payment processing are notable blockchain technology use. Blockchain technology enables lightning-fast transactions in real time. This has already transformed the banking, financial services, and insurance sector for good as it saves both time and money (mostly eliminates transaction fees charged by banks/financial institutions).

- One company that one of our investment managers is invested in offers blockchain data and analysis reports to financial institutions, exchanges, and government agencies in 40 countries across the globe. Essentially, it focuses on helping institutions monitor cryptocurrency exchanges. The company’s compliance and investigation tools enable users to monitor and identify fraudulent transactions, money laundering, and compliance violations, thereby building a reliable blockchain-based economy.

- Blockchain can help combat personal identity theft by storing crucial personal information (for example, social security numbers, birth certificates, address, etc.) on a decentralized and immutable ledger. Blockchain can provide users with comprehensive control of their information in their ID and digital identities. Large-scale corporations are familiar with the need and are developing applications that facilitate the generation of digital identities of the general public and their employees.

- Blockchain technology is used extensively in the logistics industry to effectively track the movement of goods over multiple locations. For example, global shipping giant DHL leverages blockchain-powered logistics. The data’s transparent recording on the blockchain of goods movement helps all stakeholders understand the precise location of goods. In addition to real-time tracking, blockchain integration into the supply chain can ensure security for cash transactions. It also reduces delays, extra expenditures, and human error.

- Global shipping giant DHL leverages blockchain-powered logistics to track and record information related to shipments while maintaining the integrity of transactions.

- By incorporating blockchain technology, digital media companies can protect their intellectual property (music, film and TV, photographs, books, etc.), maintain data integrity, target the right customers, and ensure that artists receive their royalty payments in due time.

- Blockchain technology allows healthcare providers and patients to share data. Medical records can be stored using blockchain technology.

Investing in Blockchain Technology is Not Gambling

Some have suggested ERS and PORS are “gambling” by investing in blockchain technologies, but this is simply untrue. As with all investments our three Retirement Systems make, staff conducts extensive research into the nature of the investments being made, the structure and health of the investment management firm making the investments, checks with other pension funds and institutional investors regarding their experience with the investment manager, and performs site visits to conduct onsite due diligence of the investment manager before making any investments. Furthermore, each Retirement System has a Board of Trustees that actively participates in the above-referenced due diligence activities, setting asset allocation targets, and in the selection of investment managers. While there is risk in any investment, staff and the Boards of Trustees are extremely careful and judicious in evaluating and selecting investments.

How Much Have We Actually Invested in Blockchain Technology

Some media reports have stated that ERS had invested 10 percent of its portfolio and PORS had invested 13 percent. Our early investments in the space have far exceeded return expectations, and as a result have been over their target allocations. As an example, the first blockchain fund we committed to in 2018 and began funding in January 2019 has already returned to the Retirement Systems well in excess of 100% of the capital invested, with an additional 200% of market value still invested. Our target return expected over the fund’s projected 8- to 12-year life is an Internal Rate of Return (IRR) of 20 to 25% and a 2.5 multiple of invested capital (MOIC). Follow this link for a further explanation of alternative investments such as these.

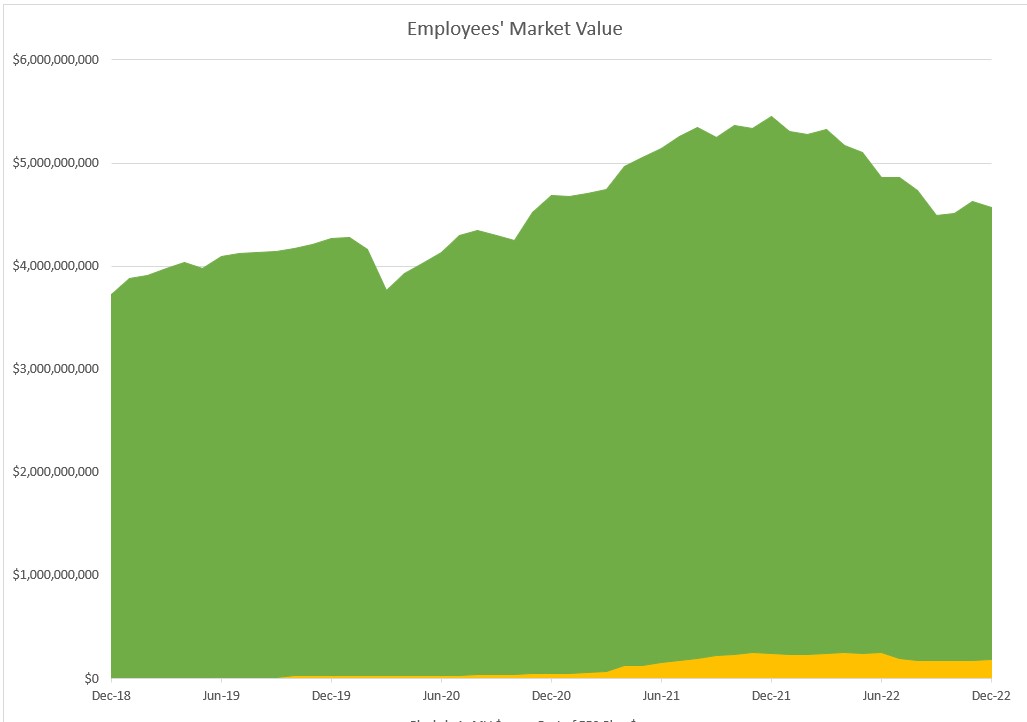

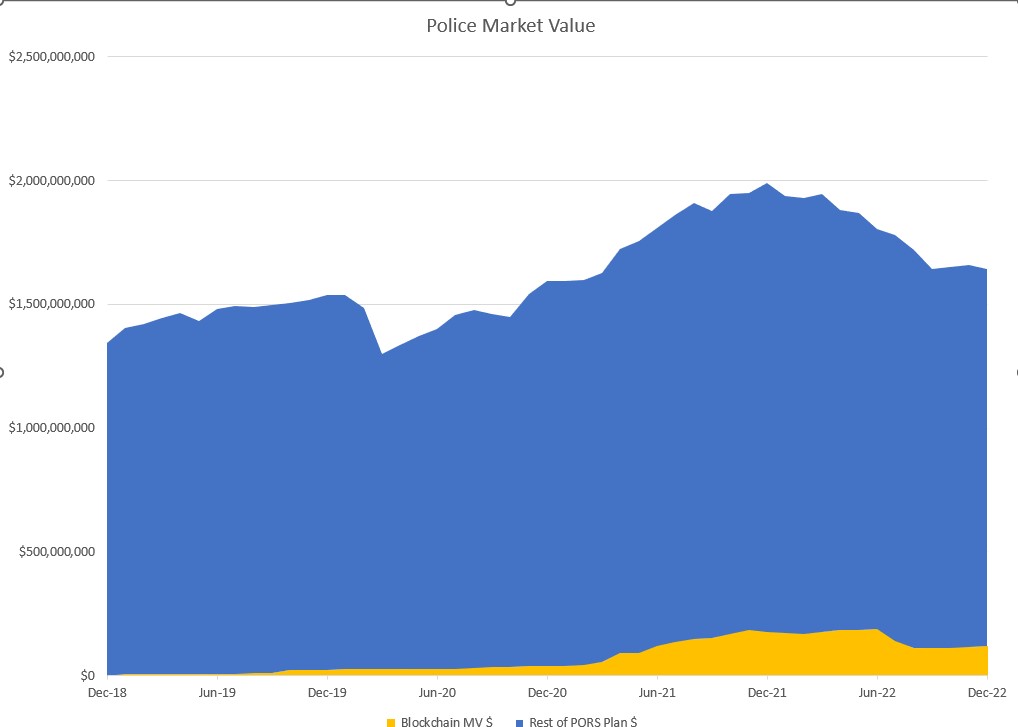

The table below shows the weightings (updated as of December 31, 2022) of our dedicated blockchain technology investment funds, in addition to Fintech oriented Venture Capital funds which have broader mandates across a range of innovative technologies that could include blockchain.

| Fairfax County | 12/31/22 | 1-Year | Highest | Cost Basis | Gain/Loss |

| Employees' | Weight | Avg. Wgt. | Weight | @ High | @ High |

| Blockchain Funds Only | 3.96% | 4.28% | 5.26% | 2.47% | 2.79% |

| FinTech Funds Only | 0.95% | 0.73% | 0.95% | 1.02% | -0.07% |

| Blockchain + FinTech | 4.92% | 5.01% | 5.98% | 3.15% | 2.83% |

| Fairfax County | 12/31/22 | 1-Year | Highest | Cost Basis | Gain/Loss |

| Police Officers | Weight | Avg. Wgt. | Weight | @ High | @ High |

| Blockchain Funds Only | 7.19% | 8.30% | 10.51% | 4.06% | 6.45% |

| FinTech Funds Only | 0.83% | 0.64% | 0.83% | 0.89% | -0.06% |

| Blockchain + FinTech | 8.02% | 8.94% | 11.13% | 4.64% | 6.49% |

The percentages shown above are an estimated percent of the Total Plan at the relevant month end. The highest blockchain and combined weight with FinTech was 6/30/22, which is elevated by the well-known reporting lag of private funds and the denominator effect of private assets relative to public market declines. The recent sharp rise of nominal and real interest rates has made 2022 a very challenging investment environment for all assets, including historical portfolio diversifiers like US Treasury bonds. This phenomenon can be seen by comparing the Highest Weight to the 1-year Average Weight. The differential in weights between the Systems comes from PORS sizing the initial blockchain investment in early 2019 at roughly the same size as ERS in dollar terms. Subsequent allocations have been similar on a percentage basis across the Retirement Systems.

To put these numbers in perspective, the charts below show combined weights of dedicated Blockchain Technology managers and FinTech funds combined, relative to the total market value of the respective System.

Advantages of Holding Tokens or Coins in a Blockchain Company

Less than 0.5% of the total ERS portfolio is invested in tokens and less than 1.0% of the PORS portfolio is invested in tokens. All liquid tokens are held at either a regulated custodial bank or at a regulated broker/dealer. The reason for holding tokens is that most blockchain tokens derive their value from their governance and utility functions, each briefly described below.

On the governance side, token holders are granted voting rights that allow them to influence future rules and decisions of a project. The main purpose is to solve for decentralization; instead of a specific centralized group of managers or IT developers making decisions, token holders can vote on how the protocol is run (e.g., vote on infrastructure or code changes).

Some tokens also have utility functions, meaning that they have a specific purpose within a particular ecosystem. For example, tokens can be used to cover transaction and network fees or provide their holders access to a blockchain-based product or service that the holders can obtain by redeeming it. When paired with a real-world use case, tokens can provide holders with financial value. This value is amplified based on the underlying usage of the network. The token value can be thought of as similar to the velocity of money, or m2, in the real world.

Whether these managers are investing in equity or digital assets, they care about the same thing: value accrual. The tokens/coins that they invest in typically confer the same two attributes they care about with an equity investment: governance rights and cash-flow. The former serves to enable, protect, and maximize the latter.

Transparency and Disclosure

A number of provisions under the Virginia Freedom of Information Act afford state and local pensions, college savings plans, and state university endowments exemptions relating to the disclosure of investment matters and materials that may have an adverse impact on the value of an investment to be acquired, held or sold by such a public entity. As the recent market volatility around GameStop (NYSE: GME) has shown, knowledge of one’s holdings can be used by other market participants to adversely impact the value of those holdings. These provisions are enacted to protect the investments of the Retirement Systems, and thus their participants and beneficiaries, and are supported by two different legal opinions (here and here) by two different Virginia Attorney Generals.

These provisions, however, do not hinder the staff of the Retirement Systems, Boards of Trustees, or county officials from reviewing such materials and holdings. As noted above, staff conducts a rigorous due diligence process, has independent operational due diligence reviews conducted, and ensures that comprehensive legal reviews are completed before hiring any investment manager. Staff continues due diligence during the time each investment manager is employed, specifically as to their investment philosophy and process, the underlying portfolio’s construction and holdings, and regular reviews. Also, our CIO’s sit on Limited Partner Advisory Committees (LPAC’s) for the funds, affording them additional insights and input into the funds’ governance.

In Conclusion

In closing, hopefully you are now reassured by the facts we have presented here. You may have noted that a member of our Staff was quoted online, however his comments were taken out of context.

Please know that all of our Staff in the Retirement Administration Agency take our responsibility to the employees, retirees, and residents of Fairfax County very seriously. Our goal is to provide the best possible retirement benefits to our members at the lowest possible cost to the county and its taxpayers. Everything we do, including how and where we invest Retirement Systems assets – is done with that goal in mind.

If you still have questions, please let me know. Feel free to email me at jeffrey.weiler@fairfaxcounty.gov or by phone at 703-279-8255.

Thanks

Jeff Weiler

Executive Director

Fairfax County Retirement Systems

UPDATED: February 14, 2023