As a part of its mission, the Park Authority offers a broad range of leisure facilities and services desired by those who live in Fairfax County. To support these facilities and services, the Park Authority charges fees that supplement the appropriation received from the County’s General Fund.

The Authority’s user fee policy authorizes that “services and facilities supported entirely, or in part, by the Park Authority Revenue and Operating Fund may have fees designated and charged, as authorized under the Park Authorities Act, offering a mechanism to increase the availability of programs and services that the General Fund does not provide.”

User fee revenues collected by the Park Authority are placed in the Park Authority Revenue and Operating Fund and are used for day-to-day operations of golf courses, Rec Centers, fee programs and store sales at Resource Management sites, rental facilities, program support at lakefront parks and Revenue and Operating Fund support operations. The Park Authority Revenue and Operating Fund is managed as a collective enterprise. Its net revenues are used to fund renovation and capital improvements at Revenue and Operating Fund sites.

Staff recommends facility fee adjustments, as needed, after analysis of facility operating and maintenance costs, and long term capital repair and replacement needs. Costs and fees are reviewed by staff on a regular basis to minimize fee changes in any one year.

The Fairfax County Park Authority Board (PAB) makes the final decision through approval of the fee schedule, after studying staff recommendations and considering citizen comments. The Park Authority Director can authorize discounts from approved fees for promotional purposes.

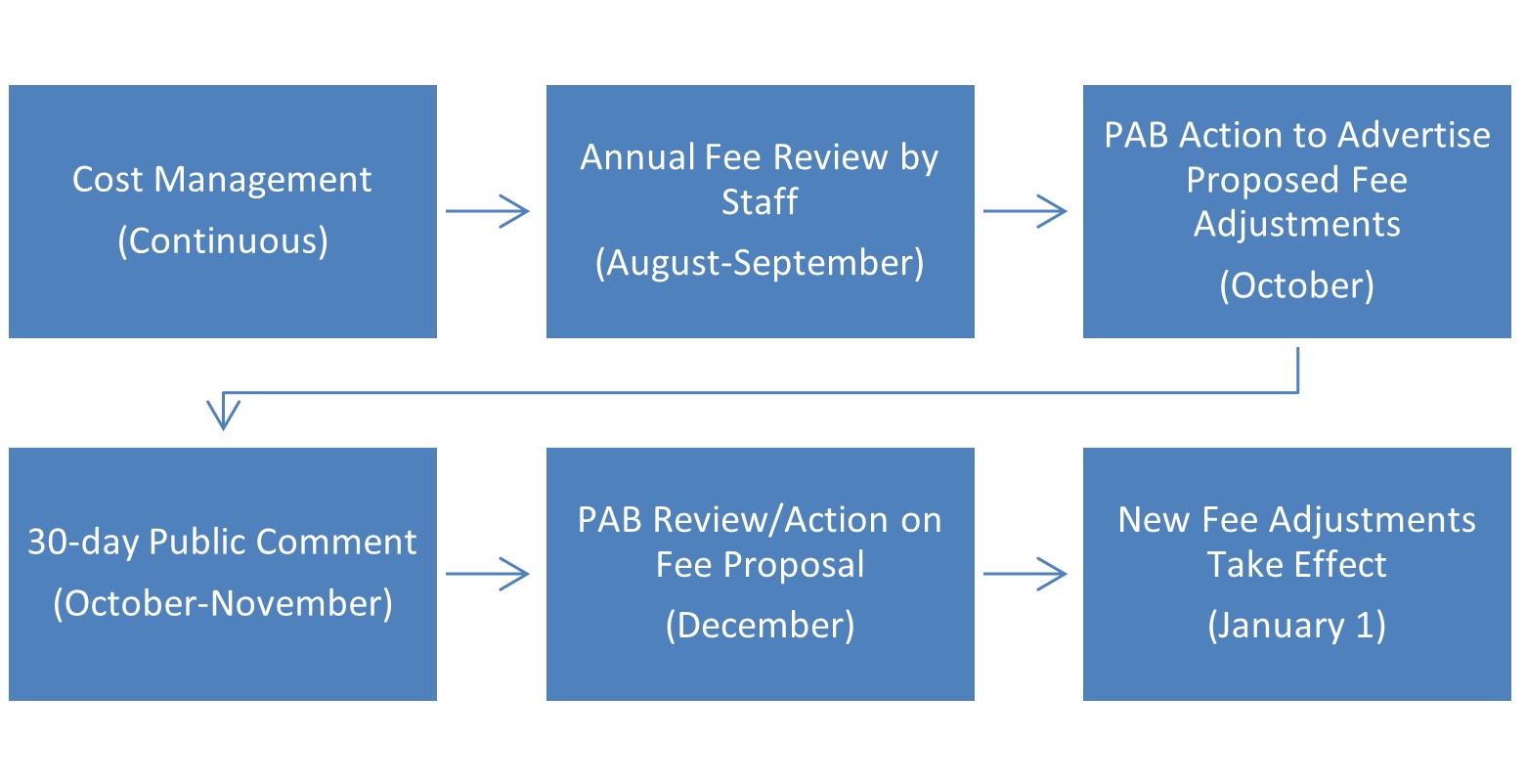

Typically, the PAB considers fee adjustments annually following the process outlined below.

During times of budgetary stress, the PAB also reserves the right to make fee adjustments as needed during other times of the year.

In general, the Park Authority follows a 4-step process in establishing fees.

- Determine the proportion of costs which the price should cover. Some fees are:

- nominal (don’t cover a significant portion of direct operational costs, e.g., carousel rides),

- meant to cover direct operational costs (e.g., Rec Center room rentals),

- targeted to cover direct costs plus overhead (e.g., full cost recovery such as Rec Center admissions)

- meant to cover direct costs, overhead and some additional marginal cost for future capital needs (e.g., greens fees).

The determination of what degree of cost recovery is appropriate is based on a notion of where a service rests on the continuum of services. Some services are felt to be of general benefit to all and are, therefore, subsidized to some degree. Others are felt to be of benefit only to those who participate. In such instances, full cost recovery is warranted.

Fee adjustments must also keep pace with increases in the cost-of-living and the cost of operations. The Washington region consumer price index (CPI) was up 2.0 percent during Fiscal Year 2025 (July 2024 to July 2025). Cumulative two-year growth was 5.7 percent.

- Determine the going rate. Others offering similar services are surveyed to ensure that Park Authority rates are generally within the range of comparable providers – public and private.

- Examine the appropriateness of fee differentials. Fee differentials are used in a variety of instances including differences based on residency, age, time, quantities purchased and promotional needs.

- Consider how patrons will perceive recommended fee changes. Will patrons feel the recommended fee or fee increase is fair? Is the increase reasonable given costs and market conditions? Will the fee reduce patron participation? Are there alternatives to reduce adverse impacts? Will the service still be perceived as a good value?

The PAB does pay attention to your comments. A public comment period on the fee proposal will run from October 30 through December 4, 2025. No decision on the proposed fee adjustments will be made until after the PAB has had an opportunity to review public comment. Action on fees is scheduled for the December 10, 2025 PAB meeting, with implementation of fee changes scheduled for January 1, 2026. Written comments are also accepted via letter or e-mail.

For instructions to submit comments or participate in the public meeting, please go to Fairfax County Park Authority 2026 Proposed Fee Schedule.

Fee adjustments for 2026 are proposed in the following areas:

- Greens Fees – all golf courses except Greendale Golf Course

- Laurel Hill Golf Club memberships – Laurel Hill Golf Club

- Power Cart Rentals – all golf courses

- Indoor Range – Pinecrest Golf Course

- Rec Center memberships – all Rec Centers

- Rec Center gymnasium rental base rates – all

- Rec Center racquetball court reservation fee – all

- Facility room rental rates – all

- Group Admission and shade structure rental – Water Mine

- Alcohol Beverage Permits – all

- Field rental – Lake Fairfax Park

- Picnic rental – all facilities

- Amphitheaters – all

- Athletic court reservation – Greenbriar Commons, Hollin Park, Hybla Valley Park, Mt. Vernon Woods Park

- Equestrian Facility rental – Frying Pan Farm Park

- Garden Plot – all

- Rental – Green Spring Gardens and Hidden Pond Nature Center

- Kayak and Pedal Boat rental – Burke Lake Park and Lake Fairfax Park

- Miniature Golf – all

- Boat launch season pass – Waterfront parks

- Tour boat rides – Lake Fairfax Park and Lake Accotink Park

The Park Authority has an obligation to provide public recreation services to the citizens of Fairfax County, so it must ensure the financial stability of its operations. One way to insure this is to require that costs and revenues from operations remain in balance. For example:

- Annual golf course and Rec Center operation and maintenance are funded by user fees, not taxes. Fees must be adjusted to ensure that operating costs as well as repair and replacement needs can be met.

- Fiscal realities over the past several years have made it impossible to maintain Resource Management facilities solely out of the General Fund (citizens’ taxes).

- Extra revenue has funded, and will continue to fund, new programs and services for park patrons.

- In response to Federal health care legislation, the Park Authority Revenue and Operating Fund is now responsible for absorbing health care costs for eligible seasonal employees.

- Facilities are aging and renovation/repair needs are increasing. User fee funds have recently been used for facility renovation projects at Rec Centers, golf courses and other facilities.

Fee adjustments are proposed to bring fees in line with the cost of providing services, to provide adequate revenue to maintain the financial health of the Park Authority Revenue and Operating Fund (the repository of user fees) and to provide patrons with affordable recreation services.

Any fee adjustments approved by the Park Authority Board on December 10, 2025 will take effect on January 1, 2026.

No. Although the fee schedule is reviewed every year, all fees do not necessarily increase annually. Some of the fees that are proposed for adjustment haven’t been changed in several years. However, in order to minimize the impact of fee increases on users, the Park Authority Board’s adopted Financial Management Annual Update does advocate employing smaller, more frequent fee adjustments rather than delaying increases for a longer period and then applying larger percentage increases to catch-up to rising costs.

The Park Authority always looks to minimize cost increases and make programmatic changes before considering fee changes. All divisions continuously monitor their use of seasonal personnel and overtime, for example, as cost cutting initiatives. Fee increases are only considered after cost control measures have been taken in order to maintain the level of quality in service delivery that users expect.

Proposed fee adjustments are essential for ensuring the ongoing financial stability of the Park Authority’s Revenue Fund, which supports the operation of facilities and programs such as golf courses, Rec Centers, lakefront parks, and cultural and historic sites. Revenue generated from user fees plays a crucial role in servicing the debt on revenue bonds used for facility developments, such as the expansion of Twin Lakes Golf Course and Oak Marr Rec Center in the 1990s, and the creation of Laurel Hill Golf Course in the 2000s. User fees have also funded recent projects and improvements including newly added furniture, fixtures and equipment at Mount Vernon Rec Center, upgraded golf equipment at our courses across the county, and the development of the Natural and Cultural Resources Management Plan.

Fee increases ensure that FCPA can continue to offer exceptional, high-quality services, enrich community programs, and invest in facility renovations and improvements that meet the evolving needs of the community. These adjustments also allow us to provide the staffing and resources necessary to maintain excellent service standards at recreational facilities and a positive experience for park users.

The PAB welcomes written comments (submitted online or by letter) received by 5 p.m. on December 4, 2025.

Comments may be submitted online.

Letters should be addressed to:

Fairfax County Park Authority

ATTN: Public Information Office/Fee Comments

12055 Government Center Parkway, Suite #927

Fairfax, Virginia 22035

Fee information is posted on the Park Authority Fee Schedule webpage.

Resident and media inquiries may be directed to the Public Information Office by email at Parkmail@fairfaxcounty.gov or by contacting the Public Information Officer at 703-246-5092.